Investment Management

Approach

We strive to be thoughtful underwriters on both sides of our balance sheet, and we have always allocated our assets to support our insurance operations, not the reverse. Because the primary purpose of our investment portfolio is to fund future claim payments, Travelers employs a risk-adjusted approach to its investment portfolio. Our asset allocation gives us a high level of confidence that our capital is adequate to support our insurance business, in both good times and bad. Our approach has served us remarkably well over a long period and allows us to invest in our businesses with an eye to the future.

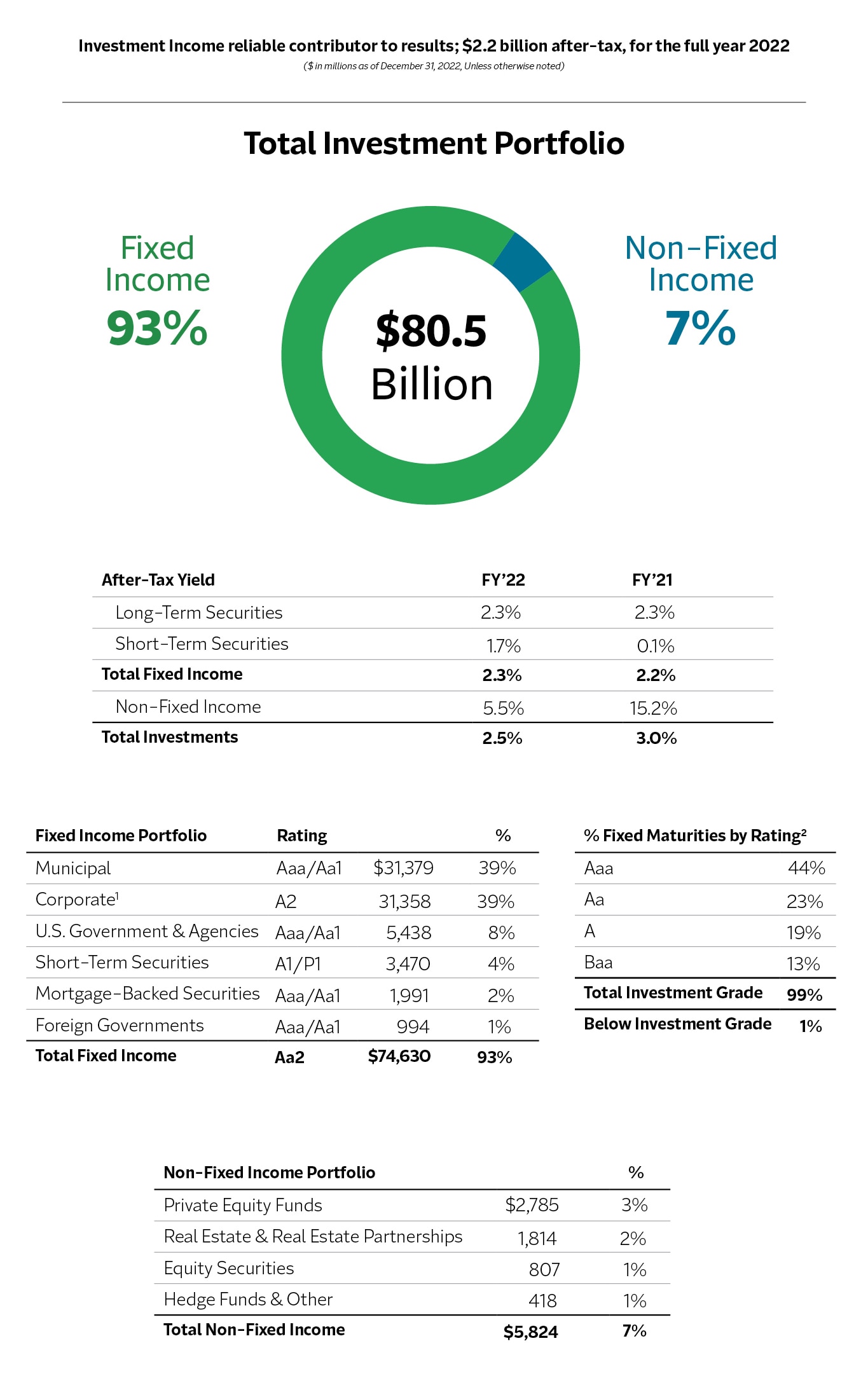

Our Co-Chief Investment Officers – members of our Management and Operating Committees – lead our investment department, which directly manages our fixed income assets (93% of our investment portfolio), as well as our investments in equity securities, real estate, private equity limited partnerships, hedge funds, real estate partnerships and joint ventures. The Investment and Capital Markets Committee of the Board oversees our investment strategy and the risks related to our investment portfolio (including valuation and credit risks), capital structure, financing arrangements and liquidity.

Well-Defined and Consistent Investment Philosophy

Our investment portfolio is a key source of stability and strength for Travelers. The portfolio is managed first and foremost to support our insurance operations, and accordingly, our investment portfolio is positioned to meet our obligations to policyholders under almost every foreseeable circumstance – anything from a global pandemic to a significant natural disaster to a financial crisis. With this in mind, we are focused on risk-adjusted returns and credit quality rather than reaching for yield that is not commensurate with the underlying risk. Our well-defined and consistent investment portfolio has been a meaningful and reliable contributor to our results year in and year out.

The performance of our investment portfolio in 2022 underscores the wisdom of our thoughtful and diversified approach. Net investment income was very strong at $2.2 billion after-tax, reflecting higher interest rates and the growth in our fixed income portfolio. While down year over year, as expected, our alternative portfolio continued to perform well, particularly in light of the significant downturn in the broader equity markets that occurred in 2022.

Looking forward, we expect to benefit from higher invested assets in our fixed income portfolio and higher interest rates. As inflation has persisted and the Federal Reserve has aggressively shifted its policy in response, the yield on new investments is now meaningfully higher than the yield on our maturing investments. With rates possibly “higher for longer,” net investment income from our fixed income portfolio should continue to grow and meaningfully contribute to our results going forward.

Investment_Management_Accordion

1 Includes $1.14 billion of Commercial Mortgage-Backed Securities with an Aaa rating and $523 million of Asset-Backed Securities with Aa1 Rating.

2 Rated using external rating agencies or by Travelers when a public rating does not exist. Rating shown are the higher of the rating of the underlying issues or the insurer in the case of securities enhanced by third-party insurance for the payment of principal and interest in the event of issuer default. Below investment grade assets refer to securities rate “Ba” or below.

Responsible Investing

As of December 31, 2022, Travelers’ invested assets totaled $80.5 billion, of which 93% was invested in fixed maturity and short-term investments. This high-quality investment portfolio generated net investment income of $2.6 billion pre-tax in 2022. In addition to achieving appropriate risk-adjusted returns, our investments enable many environmental and social improvements. As one of the largest investors in municipal bonds, we provide funding to approximately 950 different municipal issuers, with the proceeds of our investments used to improve the quality of life in communities across 47 states, the District of Columbia and Puerto Rico. For example, we invest in municipal bonds that support water and sewer projects (notional $5 billion), which help mitigate pollution, provide safe drinking water, promote conservation and, in many cases, respond to changing climate conditions. Additionally, our investments in K-12 education (notional $10 billion) and higher education (notional $4.2 billion) support enterprises directly involved in improving communities and students’ lives. We currently own $2.8 billion (notional) in fixed income securities classified as “green,” “sustainability” and “sustainability-linked” bonds by Bloomberg L.P. We also maintain smaller investments in low-income housing tax credits, which help build affordable housing. See the Investment Portfolio section in our Form 10-K for a detailed breakdown of our investment portfolio. For additional detailed information related to our investment holdings, please see our most recent annual audited statutory basis financial statements for the Travelers Combined Pool and other non-pooled entities. A summary of the investments held by investment type, country and credit rating (where applicable) can be found in the Summary Investment Schedule (Exhibit 2 for the Travelers Combined Pool Audit and Exhibit 1 for the other non-pooled companies’ audits). Additional investment information can be found in the Supplemental Investment Risks Interrogatories (Exhibit 3 for the Travelers Combined Pool Audit and Exhibit 2 for the other non-pooled companies’ audits).

ESG Factors in Investment Decisions

We recognize the importance of responsible investment and, accordingly, incorporate environmental, social and governance (ESG) factors in assessing the sustainability of the entities in which we invest. We have traditionally limited our exposure to public equity securities and other riskier asset classes. Since we invest overwhelmingly in fixed income securities, our analysis of ESG factors focuses primarily on credit risk. Our Investment Policy, approved by our Board of Directors, reflects a long-term approach to sustainable value creation and requires Travelers to consider ESG factors in the investment process, to the extent relevant.

With respect to our fixed income investments, we invest using a variety of qualitative and quantitative criteria that take into account both expected returns and risks including interest rate, credit and prepayment risks. Our fundamental investment process weighs, on an appropriate basis, financial statement data, management information, relevant ESG factors, third-party research and other information. In addition, our asset allocation process considers the expected return advantages offered in the market in compensation for bearing various risks, including credit risk and ESG risks.

We have assigned internally developed ESG scores to all issuers in our fixed income portfolio. In certain circumstances, this process has led to the exclusion of potential investments or the divestment of portfolio holdings (“negative screening”) due to ESG risks where we believed that the expected returns were not consistent with the underlying risks – in other words, where we did not believe we would be appropriately compensated for the risks that we would be assuming.

As it pertains to investments to support our insurance operations, consistent with our credit-based approach to investing, we have a policy to avoid making new debt or equity investments in companies with significant exposure to thermal coal mining, oil sands or coal-based electricity generation, to the extent consistent with applicable law and our fiduciary duties.

In addition, in our municipal bond, mortgage and real estate investments, we consider the impact that changing climate conditions may have on any given city, state or region. Since we assume catastrophe risks such as earthquakes and windstorms in our capacity as an insurer, we also seek to manage our portfolio’s credit risk to such events by assessing our investment exposures in impacted geographic areas. In addition, for municipal bond issuers in the Southwestern United States and other areas of the country susceptible to drought, all investment analyses include an assessment of water supply adequacy.

For further discussion on the incorporation of ESG factors in our investment process and the impact of the regulatory environment in which we operate on the investments we make, please see our SASB Report.

GHG Emissions and Our Investment Portfolio

Currently, greenhouse gas (GHG) emissions data for the substantial majority of segments of our investment portfolio (e.g., municipal bonds (39% of our portfolio), foreign local and regional governments (2%), mortgage bonds (2%), ABS & CMBS (2%) and private equity, hedge funds and other investments (5%)) is unavailable and, where it is available, the data quality remains inconsistent. Accordingly, at this time, we cannot accurately calculate the total emissions of our overall investment portfolio. Nonetheless, as discussed in detail above, we believe that we have incorporated the relevant risks into our investment analysis. In addition, we have attempted to quantify GHG emissions of securities within our corporate securities portfolio (corporate bonds and public equity), the only portfolio segment where some GHG emissions data is available. This portfolio represents less than one third of our overall investments. As additional emissions data becomes available over time, we expect that the total GHG emissions that we will be able to report will increase.

For a detailed discussion on our approach to calculating GHG emissions financed by our investment portfolio and the results of our calculations, please see our TCFD Report.

Climate Scenario Analysis With Respect to Our Investment Portfolio

We recently engaged a third-party vendor to perform a climate risk analysis of Travelers’ investment portfolio. This analysis combined climate stress tests with stochastic modeling of possible future economic outcomes to help us better understand the possible impacts of various scenarios on our investment portfolio.

For a detailed discussion regarding the analysis and its results, please see our TCFD Report.