Customer Experience

Approach

At the heart of who we are is our promise to take care of our customers. In the best of times, our products and services provide our customers with the security to grow and thrive. When disaster strikes, that promise can mean helping replace a totaled vehicle or helping repair a roof in time for the holidays or a special occasion. In every case, a Travelers policy means a trusted relationship that can last years, even generations, and brings value to our customers, our enterprise and our shareholders.

We recognize that to deliver on our promise and to produce industry-leading returns over time, we need to understand our customers’ changing needs and expectations, which are increasingly shaped by their experiences both inside and outside the insurance industry. Meeting and exceeding those expectations require us to keep the customer at the heart of everything we do and collaborate with our agent and broker partners to provide a seamless and consistent experience across all interactions and touchpoints.

Our Head of Customer Experience, a member of our Operating Committee, leads our enterprise-wide efforts to enhance our customer experience. We regularly conduct customer research to gain a real-time understanding of our customers’ needs. We also rely on our data and analytics expertise to develop intelligent models that help us predict and provide for their needs throughout the customer life cycle. We use these learnings to strategically invest in technologies, capabilities and talent that enable us to become faster, easier, nimbler, more digital and more personalized. Through these efforts, we continue to drive one of our three innovation priorities – to provide great experiences for our customers, agents and brokers.

Marsh McLennan, the largest insurance broker in the world, tracks its broker experience with insurance carriers. In 2022, of the corporate carriers evaluated by Marsh, Travelers received the highest Net Promoter Score (NPS) for overall experience. Providing exceptional experience for our customers and our agent and broker partners will continue to be one of our top priorities. In 2023, among other efforts, we will continue to enhance our robust self-service capabilities for our customers and our agent and broker partners.

From a claim perspective, customer experience is both a core value and a business discipline. For the overwhelming majority of claims, we do not contract third-party claim adjustors and instead rely on our own staff to respond to claims; in 2022, we were able to adjust virtually 100% of our catastrophe claims with our own employees, supported by innovative technologies, self-service capabilities and trusted service partners. This structure sets us apart in the industry, allowing us to process claims quickly and accurately, with a consistently high standard of customer service. Our claim handling capability is at the heart of our promise to our customers and proved again in 2022 to be a significant competitive advantage that results in a better outcome for our customers and a more efficient outcome for us. In 2022, we were able to resolve approximately 90% of our customers’ property claims arising out of catastrophe events within 30 days. This was a particularly remarkable result given that we responded to 64 catastrophe events and over 100,000 catastrophe notices of loss in 2022. The capacity to service virtually all of our claims with our own employees also provides us with valuable insights and data, which helps us continually learn from our customers and refine our service processes to optimize their experience with us.

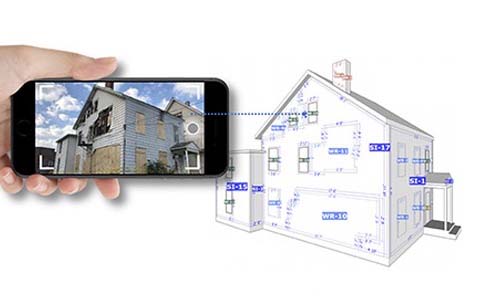

In recent years, we adjusted our claim inspection process to rely more heavily on state-of-the-art digital and virtual capabilities. In addition to creating operational efficiencies, investments in digital capabilities over the past few years have enabled us to improve the customer experience in meaningful ways. We are now using virtual claim-handling capabilities on a significant majority of both auto appraisals and wind/hail claims, often eliminating the need for inspection by a Travelers Claim professional. In other words, we are delivering great experiences for our customers and a more efficient outcome for our shareholders.

The following highlights some of the recent recognition we have received for our customer experience:

- Forbes named Travelers one of the Best Small Business Insurance Carriers (2023).

- U.S. News ranked Travelers in the top 10 for Best Car Insurance Companies (2023).

- U.S. News named Travelers one of the Best Workers Compensation Insurance Companies (2023).

- TrustedChoice.com named Travelers the Best Small Business Insurance for Professional Liability (2023).

- Corporate Insight granted Travelers awards for both Desktop Website and Mobile App (2022).

- Verint Experience Index: Property & Casualty Insurance ranked Travelers in the top 10 for customer satisfaction (2022).

- Insurance Business America awarded Travelers with a 5-Star Excellence Award for outstanding customer service in the Home and Workers Comp Insurance categories (2021).

Ultimately, the results of our customer experience efforts are reflected in our very strong customer retention rates.

Customer Retention Rates

| Business Group | 1Q’21 | 2Q’21 | 3Q’21 | 4Q’21 | 1Q’22 | 2Q’22 | 3Q’22 | 4Q’22 |

|---|---|---|---|---|---|---|---|---|

| Domestic Business Insurance (excluding National Accounts) | 83% | 84% | 85% | 85% | 86% | 86% | 86% | 88% |

| Domestic Business Insurance: Select Accounts | 79% | 80% | 81% | 81% | 83% | 83% | 83% | 83% |

| Domestic Business Insurance: Middle Market | 86% | 87% | 87% | 87% | 89% | 88% | 89% | 91% |

| Domestic Bond & Specialty Insurance: Management Liability1 | 87% | 86% | 86% | 86% | 85% | 88% | 89% | 90% |

| Domestic Personal Insurance: Automobile2 | 85% | 86% | 86% | 86% | 85% | 84% | 84% | 82% |

| Domestic Personal Insurance: Homeowners and Other2 | 84% | 85% | 85% | 86% | 85% | 84% | 84% | 84% |

| Total International Insurance1 | 81% | 80% | 81% | 84% | 82% | 86% | 81% | 85% |

1This ratio excludes surety and other products that are generally sold on a nonrecurring, project-specific basis.

2This ratio represents the expected number of renewal policies that will be retained throughout the annual policy period to the number of available renewal base policies.

Note: Statistics are in part dependent on the use of estimates and are therefore subject to change.

Human-Centered Experience

In service of our vision to be the undeniable choice for the customer and an indispensable partner for our agents and brokers, we strive to provide great experiences at every point in their journey with us – from helping them assess their insurance needs to assisting them with their purchase of insurance products and services and, should the need arise, claim resolution. To meet evolving consumer and business expectations, we continue to invest in technologies, capabilities and talent to deliver fast, personalized service across our platforms.

We work hard to provide our customers with compelling and frictionless experiences and products that help simplify their lives and provide peace of mind. We understand the importance of a human connection, especially when a customer experiences a life event such as buying a new home or investing in their business. We also understand the growing importance of new technological capabilities that meet customers and agents where they are and allow them to easily interact with us in their channel of choice. By continually enhancing our digital and virtual capabilities, we are better able to help our customers protect what is important to them, keep themselves and their employees safe and well, and get them through a covered loss.

We remain committed to maintaining the human touch while delivering this exceptional digital experience. Here are some of the ways we work hard to do that:

|

Making Sure We Have the Right People |

We aim to attract, hire and develop employees with empathy, integrity and professional expertise. Our goal is to hire and nurture people who care about the long-term success of Travelers, which includes caring about the well-being of our customers and providing exceptional service to our customers and agent and broker partners. |

|

Cultivating a Culture of Caring |

We are the beneficiaries of a long-standing culture anchored in trust – the trust we earn from our customers in challenging times and the trust we place in each other and our agents and brokers every day. The importance of the Travelers Promise – our commitment to take care of our customers, our communities and each other – is deeply ingrained in our employees and is the purpose that brings our employees to work each day with energy and enthusiasm. |

|

Human-Centered Design |

Designing exceptional experiences for our customers is both an art and a science. We continually test, learn and listen to feedback so we can better craft, monitor and optimize experiences across all lines of our business, using an outside-in, human-centric approach. |

|

Product and Loss Consultation |

Customer experience starts with ensuring that customers have the right product coverage for their risk management needs. Then, in the event of a loss, we have an innovative workflow that gives customers the option of being better informed about coverage deductibles and the claim process prior to filing an insurance claim. |

Leveraging Data and Analytics to Enhance the Customer Experience

We leverage our deep expertise in data and analytics to support decision-making and drive informed and thoughtful experience design and customer-focused innovation. We have more than 60 million data records related to businesses, individuals and distributors, including virtually every business in the United States. These records are curated into well-designed, proprietary data products. We leverage this with more than 2,000 external data sets, including high-resolution aerial imagery covering substantially all property exposures in the United States. All of this data fuels models that support risk selection and segmentation, pricing, reserving, claim response and more. Our data and analytics advantage, augmented by the latest technology, is significant and difficult to replicate. Ultimately, these capabilities lead to a better customer experience across the customer life cycle – at the time the customer purchases a policy, during the time they remain a Travelers customer and in the event of a loss.

Ethical & Empathetic Claim Culture

Treating our customers, claimants and business partners with the highest degree of integrity, professionalism and empathy and paying what we owe are core to our mission. That’s why our Claim organization has a deliberate focus on attracting, developing and retaining a high-performing workforce that shares our values and embraces our culture. We offer our Claim professionals comprehensive training designed to drive alignment with Claim’s values and vision and drive the ethical, empathetic and effective claim handling that is critical to our success. Employees are regularly recognized for their ability to make our customers feel secure, respected and cared for at every interaction.

Our Code of Business Conduct and Ethics clearly establishes Travelers’ policy to handle claims fairly by paying what we owe and following the terms of the applicable insurance policies and all claim-handling standards contained in the applicable statutes and regulations. The Code specifies that Claim personnel are expected to act promptly and in good faith when handling claims. These principles are frequently reinforced by management at all levels within the Claim department through regular training, communications and claim review. Claim professionals’ core technical training addresses coverage determination and customer communication, and our internal quality review of claim files includes determination of whether all coverages were correctly identified, applied and communicated to the customer. In addition, all Claim employees are required to annually certify compliance with a Claim-specific compliance plan that goes above and beyond the company compliance plan to specifically address good-faith claim handling.

Listening to Our Customers & Partners

At Travelers, we understand the power of listening. To that end, we aim to provide our customers and agent and broker partners with the ability to quickly and easily share feedback on our products, services and interactions. Our Customer Experience teams, which span across all Travelers business lines, regularly monitor and analyze that data to respond to customer and agent concerns while using root cause analysis to improve our processes. Our goals are to ensure that we understand our stakeholders from the start and that we use the valuable feedback we receive to develop the products and services that our customers want and need.

We strive to expand our ability to receive and act upon customer feedback, including through the use of “after call,” “chat,” and “after transaction” surveys; feedback buttons or active surveys on our digital properties; and deep quantitative research and in-depth interviews with our customers, agent and broker partners and employees. In total, we had approximately 1.5 million feedback-related interactions with customers across all of these channels in 2022. We use the extensive feedback we receive to understand what is working and what we should improve upon – all in service of our relentless pursuit of continually improving our products and services.

Here are some more ways we advance our goal of listening to our customers and agent and broker partners:

- 24/7 Customer Advocacy Help Line. With one of the most comprehensive suites of commercial and personal product offerings in the marketplace and over 30 businesses and approximately 30,000 employees, it could be difficult to reach the right person at the right time. To make it easier, our Customer Advocacy team of trained specialists is available 24/7 to help our customers, agents and brokers navigate to the right person at Travelers. Customers can find the Customer Advocacy telephone number and email address by clicking on the “Contact Us” button on the homepage of Travelers.com. In 2022, we responded to more than 80,000 customer inquiries via our help line.

- Social Media Response Capabilities. Many of today’s customers prefer to interact through social media. To address this trend, we have established a social media scanning and response capability to quickly respond to customer inquiries through social media. Any time a customer posts on a Travelers social media property or tags Travelers in a post on their social media property, we have a process to quickly review and direct that comment to the right business partner to determine if a response is needed. In 2022, we addressed over 33,000 social media posts with these capabilities, and more than 85% of our customers’ social media posts received an initial response within 45 minutes.

Ultimately, by listening to our customers, using advanced analytics and data science tools to better understand needs, and leveraging data from third parties – such as J.D. Power, Forrester and NICE Satmetrix – we can monitor our customers’ needs and evolve our processes and strategies to align more closely with the perspectives of our customers, agents and brokers.

Supporting Our Agents & Brokers

Our partnerships with our agents and brokers are a key competitive advantage for us and an important driver of our long-term success. We aim to be their indispensable partner; together, we deliver on our promise to be there for our shared customers.

To best support our agents and brokers, we continually enhance and evolve our digital marketing and sales tools, which enable our partners to better identify and capture new business opportunities. We provide our agents and brokers with customizable social media, marketing and customer relationship resources, allowing them to engage more effectively with their target markets and local communities.

In addition, we support agents and brokers as they face global challenges such as cybersecurity, inflation and marketplace conditions. For example, across all business lines, Travelers has implemented multifactor authentication with our agent and broker partners to help protect our customers, our company and each other from cybercrimes such as ransomware attacks, fraudulent sign-ins and other potential security breaches.

Here are some of the other ways we support our agent and broker partners:

Personal Insurance

- In 2022, Personal Insurance provided agents with tools to help customers understand the factors driving premium increases across the industry. By developing detailed Auto and Home Marketplace Guides, we enabled agents to confidently address premium increase questions. With our Renewal Premium Compare Tool, agents can also see why auto, home or landlord renewal premiums may have changed and find discounts that may help lower a customer’s premium.

- To support agency development, we offer READY, SET, PIVOTSM, a web-based program designed to prepare agents for the future of insurance. In addition, the Travelers Agent Leadership Program offers in-person training to help agents increase sales, improve retention, leverage digital resources and grow their bottom line.

- In 2022, we continued to offer hundreds of digital marketing resources through toolkitPlus, introduced our Quantum Home 2.0® product in New York, enhanced our Digital Quote Proposal experience and expanded our IntelliDrive® telematics offering.

Business Insurance

- In Business Insurance, we continue to digitize and streamline the transaction life cycle, so we can meet – and ultimately exceed – expectations and improve the overall experience for agents, brokers and customers.

- We provide business insurance products to agents and brokers through our dedicated online portal ForAgents and directly through multiple Agency Management Systems (AMSs). We have also deployed an industry-leading collection of Application Programming Interfaces (APIs) that connect our platforms directly into virtually every major AMS and distribution platform in the marketplace.

- For larger brokers, we’re connecting directly to the desktop of their producers, allowing them to send us account data in real time. We also continue to invest in our risk information management services capabilities, such as e-CARMA®, a key differentiator for our larger broker partners. For middle market customers who typically have more complex insurance requirements, we have updated our APIs so agents and brokers can digitally send multiline submissions via their own internal systems. And for smaller commercial customers, we have updated our APIs to return indications or fully bindable quotes for both Business Owner Package and Workers Compensation policies.

- Additionally, we continue to roll out Travis℠ – our new proprietary rate, quote and issue platform – to additional lines of business and states. With 60% fewer questions and 50% fewer screens, Travis significantly reduces the time and effort to compare rates, provide quotes and issue policies, thereby improving the experience for agents and customers alike.

Bond & Specialty Insurance

- In Bond & Specialty Insurance, we continue to improve the agent experience by enhancing the convenience, connectivity and responsiveness of our digital solutions for Surety & Management Liability. We are leveraging our significant data advantage to improve time to market and deliver enhanced risk management content for our distribution partners and customers.

Travelers Institute® educational programming also offers unique value to our network of 13,500 agent and broker partners, providing a distinguished thought leadership platform. Over the course of more than a decade, the Travelers Institute has hosted more than 700 events in collaboration with agents and brokers, enhancing these relationships while providing education and risk mitigation strategies to thousands of consumers.

The programming leverages our agents’ knowledge of how issues such as cybersecurity, distracted driving and natural disasters directly affect families, businesses and communities. Agencies and agent associations regularly co-host programs with the Travelers Institute, invite customers and provide expert speakers, showcasing their risk management expertise and reinforcing their value as trusted advisors for critical insurance decisions. In addition, the Travelers Institute offers presentations on the economic outlook and political landscape at agent conferences and events and provides educational content, including publications, social media campaigns and videos, for agents and brokers to share with clients.

During the pandemic, the Travelers Institute continued to foster these relationships and provide educational programming through its new Wednesdays with Woodward® webinar series. The series launched in June 2020 to explore personal and professional issues impacting our agents, our brokers, our customers, our employees and the communities we serve. Seventy-seven programs have been held through the end of 2022, with topics including telematics-based insurance programs, cross-sector efforts to fight cybercrime and mental well-being in the workplace, among many others. Notably, the Travelers Institute hosted the webinar 60 Minutes in Personal Insurance: Opportunities in a Changing Marketplace, highlighting significant trends impacting midsized businesses and providing shared insights that insurance agents and brokers can use to find opportunities amid a changing risk landscape.

Additional programs explored distribution and agency trends for personal insurance and commercial insurance. These included the following webinars:

- Thrive: How Insurance Agents & Brokers Will Succeed in 2022

- 60 Minutes in the Middle Market: Opportunities in a Changing Marketplace

- The Future of Fighting Insurance Crime

Travelers Institute programs are a great example of how our efforts to strengthen our communities also enhance our relationships with our agent and broker partners and drive our bottom line. In 2022, nearly 90% of agents and brokers who responded to post-program surveys reported that the content was “very” or “extremely” valuable to them, while their comments often highlighted that these programs are shared throughout their teams.