Innovation

Approach

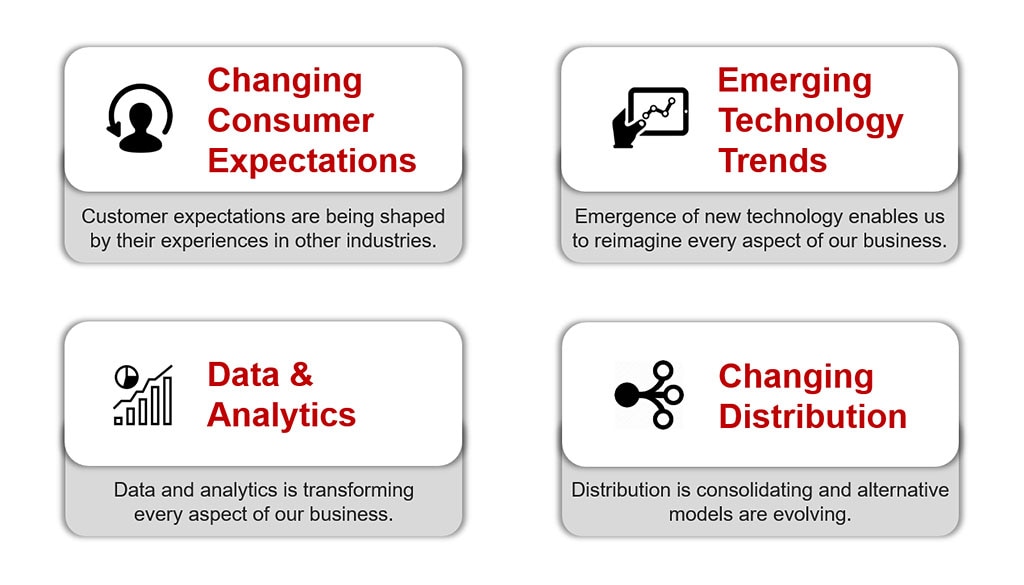

As one of the United States’ largest multiline insurers, we continually invest in data, analytics, technology and operations to make our processes more efficient and effective to better serve our customers and maintain our competitive edge. Our competitive advantages set Travelers apart; they are foundational to the success of our long-term financial strategy. Nonetheless, we understand clearly that the world is changing, and changing quickly. Broadly speaking, we see four significant forces of change impacting our industry:

Forces of Change

Forces_Of_Change

We are pursuing an ambitious innovation agenda that is focused intently on these forces of change and is designed to ensure that our competitive advantages remain relevant and differentiating to drive our long-term success.

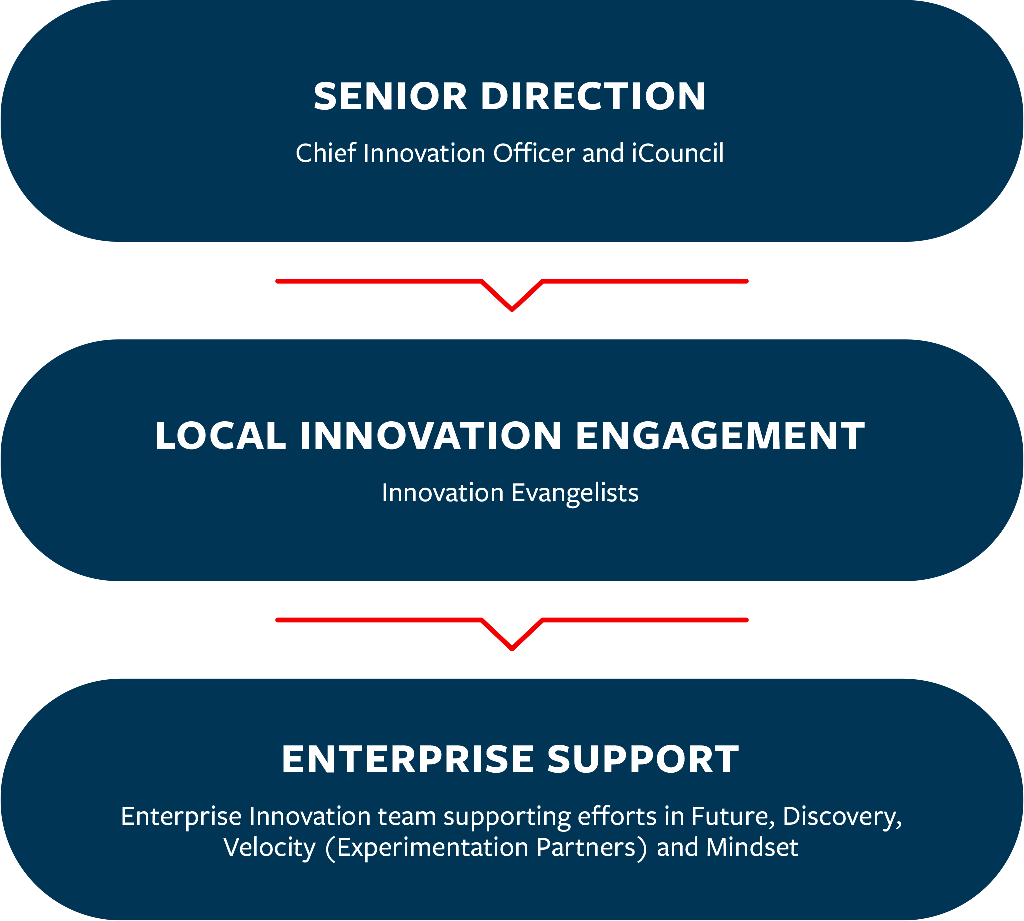

We believe the winners in our industry will be those with deep domain expertise who can continue to deliver industry-leading results while innovating successfully on top of a foundation of excellence. To ensure that we keep pace with the accelerating rate of demographic, economic, technological and cultural change in today’s consumer and business environment, we have adopted a focused approach to innovation as a business discipline. Our Chief Innovation Officer leads a dedicated team of innovation specialists who focus on championing and supporting experimentation across the enterprise and enable connections to new capabilities in external ecosystems. The Travelers iCouncil, composed of senior leaders, oversees our innovation initiatives across the enterprise, helping to ensure consistency and streamline our innovation efforts.

At the same time, our Technology & Operations teams, led by our Chief Technology & Operations Officer, are also actively engaged in our ambitious innovation agenda by driving our digital transformation and advanced data and analytics initiatives. As we scale our agile practices across the organization, including through cross-functional groups, we continue to reinforce our leading position in the industry. We are also deeply committed to modernizing our technology architecture to enable us to continue delivering new business capabilities – driving our performance today and positioning us for the future.

Our “perform and transform” call to action, discussed in our Chairman and CEO's message, and our culture of innovation have become important parts of our DNA. Our collaborative approach to innovation helps us “focus on the future” by bringing an innovative mindset to everything we do, forging strategic internal and external partnerships and accelerating new ideas with speed and direction – or, as we refer to it internally, “innovating with velocity.”

We are pursuing innovation in service of our vision to be the undeniable choice for the customer and an indispensable partner for our agents and brokers. In support of that vision, we have three innovation priorities:

- Extend our advantage in risk expertise. We seek to extend our advantage in risk expertise. We have been a leading property casualty insurer over many years by being excellent at understanding risk and the products and services our customers need to manage their risk. Core to that is our ability to balance the science and art of risk-based decision-making based on data and analytics. That skill set requires a combination of deep expertise and a special culture that values collaboration and long-term success. It is an important competitive advantage developed over a long period of time and one we believe is very difficult to replicate. We seek to extend our advantage by investing in areas such as predictive modeling, advanced analytics, robotic process automation, machine learning, artificial intelligence and new products.

- Provide great experiences for our customers, agents and brokers. We are laser-focused on providing great experiences for our customers, distribution partners and employees. We are investing in technologies, capabilities, and talent to become faster, nimbler, more digital, more mobile and more personalized. When we think there is a proprietary advantage, we invest in building these capabilities ourselves. In other cases, we partner with, invest in or acquire organizations – both established businesses and startups – to bring these great experiences to market more efficiently. Both approaches have resulted in new and enhanced capabilities, such as on-demand certificates of insurance for Small Commercial accounts, ongoing improvement to our self-service web experience, a completely redesigned mobile app, virtual home and auto inspections, nurses making virtual visits, loss consultation and digital claim payments, to name a few.

- Optimize productivity and efficiency. We are continually working to optimize our productivity and efficiency to enhance our operating leverage. This is not just about tightening the belt; it is about bringing a real strategic lens to the way we think about how we do what we do in an effort to do more with less. Enhanced operating leverage provides us with the flexibility to let the savings fall to the bottom line, reinvest the savings and/or compete on price without compromising our return objectives.

Discovering Emerging & Future Opportunities

As a leading property and casualty insurer with deep industry expertise and a long-standing commitment to learning, we believe that our employees, and the knowledge and insight they bring to serving our customers, underlie all of our key competitive advantages. We combine our talent and expertise with data, analytic tools and research capabilities to identify emerging and future opportunities to provide our customers with the products and services they need to protect what’s important to them.

We track key trends that offer clues to how the future may evolve so that we are better positioned as customer preferences and expectations continue to evolve with time. We have in-house teams dedicated to researching and formulating educated viewpoints about the future of society, technology and the insurance industry, driving our long-term strategic priorities. From autonomous vehicles to artificial intelligence (AI), we systematically assess new technologies, plan for their potential impact and identify the business opportunities that may arise as a result.

In addition to watching industry trends, we continually evaluate evolving risks to our customers and help them with mitigation opportunities. We can test real-life scenarios at our research and training facilities – Claim University, the National Catastrophe Center and the Risk Control Forensics Laboratory. Sharing what we learn with our underwriters helps them better select and price risks and develop products and services that address emerging risks to meet customer needs. These insights also give our Risk Control professionals a competitive edge, allowing them to work effectively with customers to help them identify occupational risks and mitigate and manage exposures to loss. In addition, our learnings allow our customers to help improve their employees’ safety and wellness, as well as their own business results. Finally, these insights enable our Claim professionals to help our customers recover from losses quickly and efficiently. We also share our insights with our customers and the public through our agent and broker partners, our Prepare & Prevent website, Travelers Institute® and MyTravelers® for Business.

Fostering External Partnerships

With emerging trends and future scenarios in mind, our dedicated innovation scouts help us forge new partnerships and alliances outside of Travelers to broaden our perspective, gain early access to new ideas and develop solutions to some of the most compelling challenges impacting the industry. We position ourselves in the flow of innovation around the globe by collaborating with incubators, startups, venture capital and private equity firms, and others that are developing exciting new technologies and capabilities. We partner with incubators like Plug and Play and FinTech Innovation Lab New York, and global accelerators like SOSA, based in Tel Aviv. These innovation programs bring together startups from across the globe and some of the world’s largest corporations. Through these partnerships, we participate in initiatives such as the Hartford InsurTech Hub, a collaboration of insurance carriers, representatives of the City of Hartford and community stakeholders, all focused on industry evolution through collaboration and innovation. The goal of this group is to develop a local innovation ecosystem supported by local resources, capabilities and talent, in which insurance technology startups can grow and flourish. We view our involvement in this Hartford-based initiative as an investment in both our communities and our business.

To engage future talent and address industry challenges, we are partnering with academic institutions such as the University of Connecticut (UConn) and Kennesaw State University (KSU) in Georgia. In joint projects with UConn, the Travelers Data & Analytics team is focused on artificial intelligence, machine learning techniques and statistical modeling. Together with KSU, we applied theoretical concepts to real-world AI problems and co-authored four research papers on using AI in a responsible manner while reducing potential classification errors. The first research paper1 won the Best Student Paper award at the 2022 Institute of Electrical and Electronics Engineers’ International Conference on Semantic Computing for proposing innovative and practical approaches to mitigating classification errors when building language models. In addition, as part of our partnership with KSU, we formed the Travelers Responsible AI Lab (TRAIL) at KSU, with a continued focus on leading-edge AI research.

Our external partnerships help advance our data and AI capabilities. We continue to assemble new third-party data sets while refining our existing data to unlock new sources of insights and drive automation and productivity. For example, we set out to find new ways to expedite the process used to detect total losses from wildfires, specifically in the most prevalent fire loss areas of the western United States. Using third-party imagery collected from previous California wildfires, we tapped into our property boundary data to isolate home locations in the pictures. We then crowdsourced the tagging of 40,000 images, enabling a deep learning model to analyze the data and immediately assess which properties were total losses. The identification of total losses from imagery enables us to initiate the claim process faster, which, in turn, allows our customers to begin recovering and rebuilding their properties more quickly.

1 "Directional Pairwise Class Confusion Bias and Its Migration,” Statistics and Analytical Sciences article, Spring 3-2022, Institute of Electrical and Electronics Engineers, 16th International Conference on Semantic Computing.

Driving an Innovation Mindset & Velocity

We built our internal innovation ecosystem to develop the key capabilities needed for the future by leveraging the best talent and ideas from both inside and outside our company. In collaboration with our dedicated Innovation team, our network of Travelers leaders spanning our businesses and functions – our Innovation Evangelist Network – take ownership of crafting the innovation objectives for their respective business lines. This network is supported by hundreds of subject matter experts, software engineers, design specialists and data and analytics professionals. These teams deploy their unique insights, perspectives and skills to bring innovative products and services to market and optimize productivity and efficiency to better serve our customers and agent and broker partners.

Supporting our evangelists and business leaders are our Experimentation Partners, who enable innovation within the business through mentoring, coaching, facilitation, tools and testing platforms. They provide:

- A best-in-class innovation methodology to rapidly bring ideas to life, supported by tools, training classes and online resources.

- Innovation designers to facilitate problem definition, information gathering, experiment design and, ultimately, the building of robust business cases for new ideas.

- A platform for rapid test-and-learn, with technology and engineers available to enable experimentation at scale, leveraging the latest software tools and emerging technologies inside and outside the company.

- Help solving critical business problems and driving velocity within our innovation agenda.

Innovation_Mindset

We developed tools, training, communications and events to foster an innovation mindset throughout Travelers. Notably, to elicit new ideas, we regularly host hackathons, which we refer to as “Innovation Jams.” Participants collaborate and compete over the course of 24 hours to develop prototypes that address business challenges. Innovation Jam participants include Travelers employees from the United States, Canada and Europe and span all of our business functions. The events bring together employees’ knowledge and expertise in insurance, technology, design, customer experience, marketing and communications, among other disciplines, to solve critical business problems in new and creative ways. Now in its eighth year, our annual Innovation Jam has engaged thousands of employees, inspired a number of practical solutions and led to over 60 patent applications by Travelers. The 2022 Innovation Jam, which was conducted both virtually and in person, drew over 1,000 employees in more than 150 teams.

Harnessing the Power of Data

Data and analytics can help us explain events from the past or anticipate what may happen in the future. At Travelers, we believe data and analytics are transformative, strategic assets that provide us with a competitive advantage, help create great customer experiences and improve the overall productivity and efficiency of our business.

Our Data and Analytics team, led by our Chief Data and Analytics Officer, has strong partnerships across the enterprise and is responsible for executing our strategic data and analytics priorities. Through our data and analytics capabilities, we are providing solutions to challenges in our business and our industry, with the explicit goal of further extending our data and analytics advantage to drive industry-leading performance for years to come.

Travelers has been using data and analytics for more than 160 years, but the world is constantly evolving. Our Data and Analytics team continually incorporates new sources of data to further enhance our risk insights and optimize our operational decisions.

Each year, we:

- Process more than 1 million loss notices.

- Respond to roughly 20 million quotes.

- Answer more than 10 million calls from customers and agents.

That equates to more than 30 million “events” per year, or roughly 100,000 different business interactions a day, that can be optimized through the innovative use of technology, data and analytics – the three ingredients that are at the core of our digital journey and that we believe will help us reimagine those business interactions over time.

We are accelerating our transformation by expanding omnichannel customer engagement and leveraging advanced analytics and artificial intelligence to drive better risk segmentation, boost productivity, improve operational efficiencies and create great experiences for our customers, agents and brokers.

Responding to the needs of our customers and business teams, we have prioritized design-thinking tools and have shifted from a project management focus to a product-led mindset. This means that small teams composed of individuals from a mix of disciplines and functions are responsible for specific products and are empowered to make decisions that help drive business outcomes and speed to market.

We’ve also shifted to an engineering mindset throughout the Technology & Operations teams, such that instead of simply translating business requirements into code, our engineers are more directly integrated into the business and are thus better able to understand and appreciate the digital business drivers in today’s market. These mindset shifts help inform how we interact with our customers, agents, brokers and employees to create frictionless digital experiences.

Cultivating Our Data Culture

Our Data Culture program was launched in 2020 to reinforce the strategic value of data and how it impacts our business. The program is intended to ensure that all employees take ownership of data, understand and protect data, capture data appropriately and make sure the data they are using is accurate and timely. Program highlights include:

- Engagement. Creating awareness and understanding of the importance and impact of data.

- Learning and Development. Offering programs to support a community of continual learning and growth.

- Enablement. Providing tools and resources to aid in maturing a data-driven culture.

As part of this program, our new Leadership Series prepares our operational leaders to become even better consumers of data and analytics capabilities, extending beyond traditional uses in product risk segmentation and enabling them to reimagine work across the value chain. Through this series, we seek to enable better decision-making, enhance productivity and build improved experiences for our agents, brokers, customers and employees – all of which help us maintain and advance our industry-leading performance.

Innovative Products & Services

The forces of change in our industry present not only risk but also significant opportunities. We continually leverage our innovation ecosystem and data-centric culture to provide new products and services to the insurance market that align with our three strategic innovation priorities. Here are some examples of those innovative products and services and how we are using technology to deliver them.

Products_Services

To learn about how our innovative products and services incentivize health, safety and/or environmentally responsible actions and behaviors, see our SASB report.

Illustrative Initiatives

Our Drivers of Sustained Value

INNOVATIVE PRODUCTS & SERVICES

|

Connected Protection |

|

|

Using AI to Streamline Submission and Quoting Processes |

|

|

Travelers' Third-Party Claims Administration Services |

|

|

BrokerTech Venture |

|

|

Digital Delivery of Policy Documents |

|

|

Risk Management Information Services (e-CARMA®) |

|

|

MyTravelers® for Business |

|

|

Global Companion℠ Plus+ |

|

|

Groundspeed Analytics |

|

|

Travelers BOP 2.0 |

|

|

Certified Data Products |

|

|

Project Loss Insurance |

|

|

Cyber Risk Management Expertise and Services |

|

|

Management Liability Offerings via Travis |

|

|

Travelers Click® |

|

|

TRV Marketplace |

|

|

InsuraMatch |

|

|

Simply Business® |

|

|

Zensurance Investment |

|

|

MyTravelers® Repair Network for Auto |

|

|

Catastrophe Event Analytics |

|

|

QuantumSubroSM |

|

|

Drones in Property Inspection |

|

|

Preferred Contractor Network |

|

|

Mental Health App |

|

|

Virtual Inspection Tools |

|

|

Operational “Bots” |

|

|

Settle My Claim |

|

|

Construction Vibration App |

|

|

Forensics and Digital Forensics Laboratories |

|

|

Ergonomics Specialist Expertise and Technology |

|

|

Personalized Risk Control Advice |

|

|

Risk Control |

|

|

Fire Protection System Impairment Management Tool |

|

|

Helping Contractors Manage the Cost of Risk |

|

|

Pump Loan Plus® |

|

|

RightTouch |

|