Governance Practices

Approach

Our commitment to good corporate governance is reflected in our Governance Guidelines, which describe the Board’s views on a wide range of governance topics. These Governance Guidelines are reviewed annually by the Nominating and Governance Committee, and any changes deemed appropriate are submitted to the full Board for its consideration. Our Proxy Statement discusses our robust corporate governance practices, which are designed to support sustained value creation for our shareholders.

The Board works with management to set the short-term and long-term strategic objectives of our company and to monitor progress on those objectives. Strategic topics are generally discussed at each Board meeting, and the Board and management participate in a separate strategy session each year. In setting and monitoring strategy, the Board, along with management, considers the risks and opportunities that impact the long-term sustainability of our business model and whether the strategy is consistent with our core values, culture and risk appetite. The Board regularly reviews:

- Our progress with respect to our strategic goals.

- The risks, including the environmental, social and governance (ESG) risks, that could impact the long-term sustainability of our business.

- The related opportunities that could enhance our long-term sustainability.

The Board oversees these efforts in part through its standing committees, based on each committee’s responsibilities and areas of expertise. Each committee regularly reports to the Board regarding its areas of oversight responsibility. The Board has allocated and delegated risk oversight responsibility to its committees in accordance with the following principles:

| Committee | Responsible for oversight of: |

|---|---|

Audit |

|

Risk |

|

Compensation |

|

Investment and Capital Markets |

|

Nominating and Governance |

|

|

Each committee is also responsible for monitoring reputational risk to the extent arising out of its area of responsibility. | |

Each Board committee has a written charter, which contains specific responsibilities, including the risk oversight functions listed above.

With a focus on continually improving the ability of the Board to provide informed oversight, the Nominating and Governance Committee oversees educational sessions for directors on matters relevant to our company, business strategy and risk profile. For example, topics of those sessions have focused on the role that corporate culture and board oversight played in publicized lapses in corporate governance at other firms.

The Board and each of its committees evaluate the allocation of oversight responsibility at least annually, along with their respective performance and effectiveness.

To learn more about the specific risk oversight functions delegated to each Board Committee and our Enterprise Risk Management activities, see the Capital & Risk Management section of this site, and view our Proxy Statement to see specific Board Committee responsibilities.

Management and Oversight of Sustainability Matters

With respect to oversight of ESG-related risks and opportunities, each committee is assigned responsibility for oversight of matters most applicable to its charter responsibilities. We believe that allocating responsibility to a committee with relevant knowledge and experience improves the effectiveness of the Board’s oversight. For example, as indicated above, the Audit Committee oversees risks related to regulatory and compliance matters; the Compensation Committee oversees implementation of our pay-for-performance philosophy and practices designed to ensure equitable pay across the organization; the Nominating and Governance Committee oversees our workforce diversity and inclusion efforts, public policy initiatives and community relations; and the Risk Committee oversees strategies pertaining to management of catastrophe exposure, changing climate conditions and information technology, including cybersecurity.

In addition, our Chief Sustainability Officer and our management-level ESG Committee—a multidisciplinary committee consisting of senior company executives that meets at least quarterly—drive the prioritization and management of, and reporting on, sustainability issues. We also regularly engage with our investors, our customers, our employees, our agents and brokers, regulators, rating agencies and other stakeholders on business issues and the ESG topics of interest to them.

To learn more about our shareholder engagement, including with respect to ESG matters, please see our Proxy Statement.

To learn more about our stakeholder engagement and how we identify our priority sustainability topics, see the About Our Sustainability Reporting section of this site.

Board Independence & Diversity

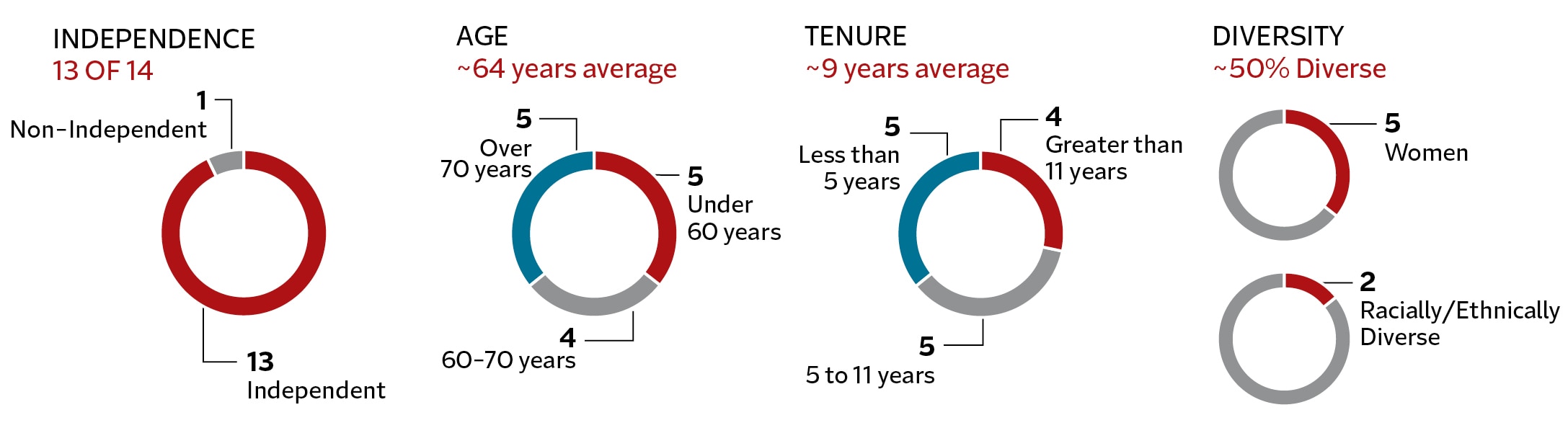

An effective and independent Board of Directors is critical to good corporate governance. All of our directors, other than our Chairman and CEO, are independent. All committees are comprised of independent directors, other than the Executive Committee on which our Chairman and CEO serves.

The Board has an independent Lead Director. The independent Lead Director coordinates the efforts of the independent directors and has the authority to, among other things, convene and chair meetings of the independent directors as deemed necessary, as well as to approve the Board meeting schedules and meeting agenda items.

To further ensure effective independent oversight, independent members of the Board regularly meet in executive session with no members of management present. Executive sessions are chaired by the independent Lead Director. Each of the committees also meets regularly in executive session. For additional information on our Board structure and the role of the independent Lead Director, see our Governance Guidelines and our Proxy Statement.

The members of the Board have a broad range of skills, expertise, industry knowledge, viewpoints and backgrounds and include five women and two racially/ethically diverse directors. The Board and the Nominating and Governance Committee carefully consider the importance of diverse viewpoints, backgrounds and experiences and other demographics when selecting future director nominees. The Board seeks to ensure that it is composed of members whose particular expertise, qualifications, attributes and skills, when taken together, allow the Board to satisfy its oversight responsibilities effectively.

Another factor considered in board composition is maintaining a balanced approach to board refreshment, with the intent of ensuring an appropriate mix of long-serving and new directors. Our Governance Guidelines contain a director age limit, providing that no person who will have reached the age of 74 before the annual shareholders meeting will be nominated for election at that meeting without an express waiver by the Board. The Board believes that waivers of this policy should not be automatic and should be based upon the needs of the company and the individual attributes of the director.

Director Snapshot

Director_Snapshot_Accordion

Board & Executive Compensation

Our director and executive compensation programs are designed to reinforce a long-term perspective and to align the long-term interests of our executives and directors with those of our shareholders.

Director Compensation Highlights

- Under the director compensation program, nonmanagement directors currently receive more than 50% of their annual board and committee chair compensation in the form of deferred stock units. The shares underlying these units are not distributed to a director until at least six months after the director leaves the Board, aligning director interests with those of long-term shareholders.

- Nonmanagement directors are required to accumulate and retain a level of ownership of Travelers equity securities equal to four times the director’s most recent annual deferred stock award.

- The Nominating and Governance Committee reviews the appropriateness of the director compensation program at least once every two years.

Executive Compensation Highlights

With our pay-for-performance philosophy and compensation objectives as our guiding principles, we deliver annual executive compensation through the following elements:

|

Element |

Metrics |

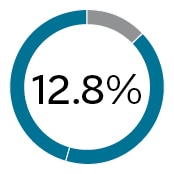

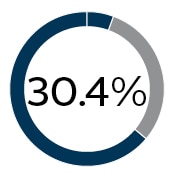

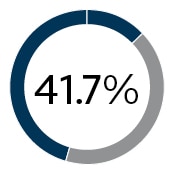

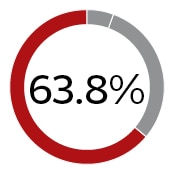

CEO Compensation Mix |

Other Named Executive Officers (NEOs) | |

|---|---|---|---|---|

|

Fixed |

Base Salary |

Base salaries are appropriately aligned with Compensation Comparison Group. |

|

|

|

Performance-Based Cash |

Annual Cash Bonus |

The Compensation Committee evaluates a broad range of financial and nonfinancial metrics in awarding performance-based incentives. Core return on equity is a principal factor in the Compensation Committee’s evaluation of the company’s performance. The Committee also considers other metrics, including core income and core income per diluted share, and the metrics that contribute to those results. |

|

|

|

Performance-Based Equity |

Long-Term Stock Incentives |

Annual awards of stock-based compensation are typically in the form of stock options and performance shares. Because our performance shares only vest if specified core return on equity thresholds are met, and because stock options provide value only if our stock price appreciates, the Compensation Committee believes that such compensation is all performance-based. The mix of long-term incentives for the CEO and other named executive officers is approximately 60% performance shares and 40% stock options, based on the grant date fair value of the awards. |

|

|

- Our executive compensation program links compensation to the achievement of our short-term and long-term financial goals and strategic objectives.

- As part of our long-standing pay-for-performance philosophy, we utilize performance measures that are intended to align compensation with the creation of shareholder value and reinforce a long-term perspective.

- The Compensation Committee believes that the most senior executives, who are responsible for the development and execution of our strategic and financial plans, should have the largest portion of their compensation tied to performance-based incentives, including stock-based compensation, the ultimate value of which is dependent on the performance of our stock price over time and our three-year core return on equity. Accordingly, the proportion of total compensation that is performance based increases with successively higher levels of responsibility.

- Our executive compensation program reflects established and evolving corporate governance standards, including:

- A maximum cash bonus opportunity with regard to our CEO.

- A robust share ownership requirement of six times base salary for the CEO, three times base salary for vice chairmen and executive vice presidents and the equivalent of base salary for senior vice presidents.

- A clawback policy with respect to cash and equity incentive awards to our executive officers.

- The prohibition of hedging transactions as specified in our securities trading policy.

- The prohibition of pledging shares without the consent of Travelers (no pledges have been made).

For more detail regarding our executive compensation program, see the Compensation Discussion and Analysis section of our Proxy Statement.

Shareholder Rights

Travelers Articles of Incorporation and Bylaws, together with our Governance Guidelines, define and protect our shareholders’ rights, including through:

- Annually Elected Directors. The annual election of directors reinforces the Board’s accountability to shareholders.

- Proxy Access. Shareholders may include director nominees in our Proxy Statement if certain conditions are met.

- Majority Vote Standard for Director Elections. In uncontested elections, a director who receives fewer votes ‘‘For’’ election than ‘‘Against’’ must promptly tender a resignation to the Board.

- Single Voting Class. Travelers common stock is the only class of shares outstanding.

- No Poison Pill. Travelers does not have a poison pill.

- Right to Call a Special Meeting. Special meetings of the shareholders may be called at any time by a shareholder or shareholders holding 10% of voting power of all shares entitled to vote or 25% where the meeting relates to a business combination.