Financial Performance: 2024 Results

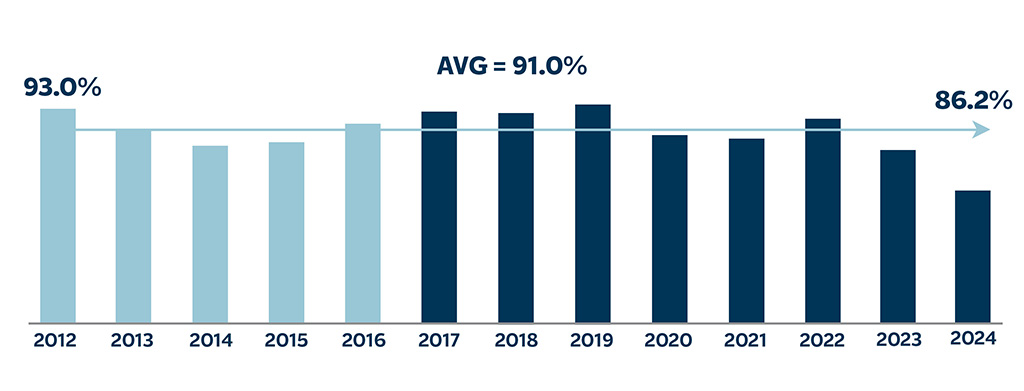

Travelers delivered core income of $5 billion, or $21.58 of core income per diluted share, generating core return on equity of 17.2% – an exceptional result and a meaningful spread over both the 10-year Treasury and our cost of equity. We achieved these excellent results in the face of record catastrophe losses. We delivered a record $4.5 billion of after-tax underlying underwriting income, an increase of nearly 40% compared to last year’s then record, and an underlying combined ratio that improved 330 basis points to an excellent 86.2%.

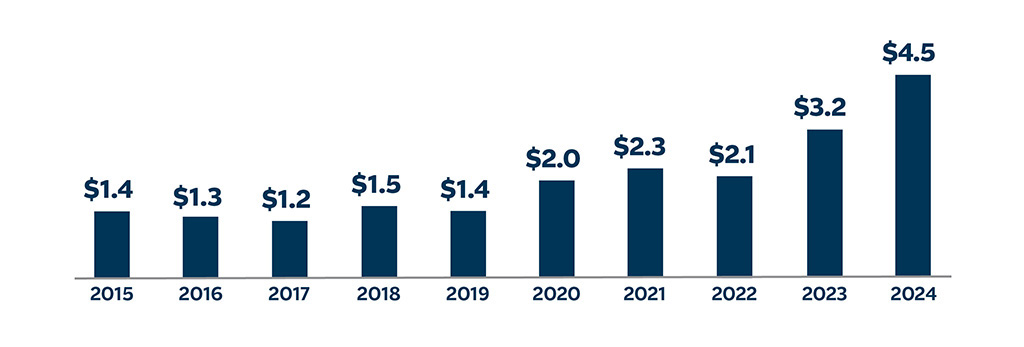

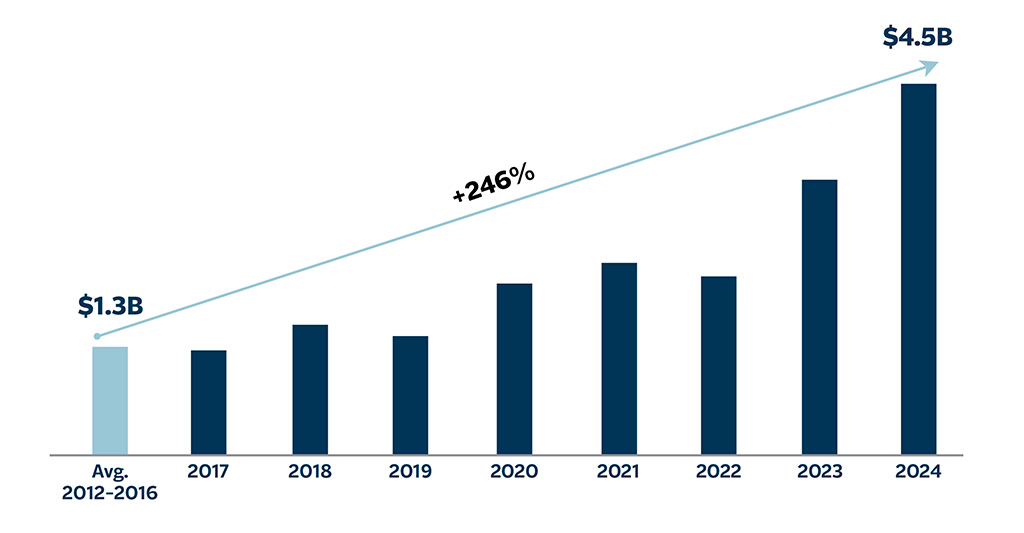

This year’s outstanding underlying underwriting results are even more impressive when considered in their historical context. As illustrated by the chart below, prior to 2020, underlying underwriting income had never exceeded $1.5 billion. Since that time, we have taken underlying underwriting income to an entirely new level by profitably growing our business.

Underlying underwriting income1 (in billions, after-tax)

Bar chart displaying Underlying Underwriting Income after-tax generally increasing from 2015 through 2024. In 2024, the underlying underwriting income was $4.5 billion, compared to $3.2 billion in 2023. This chart excludes the impact of net prior year reserve development and catastrophe losses.

1 Excludes the impact of net prior year reserve development and catastrophe losses.

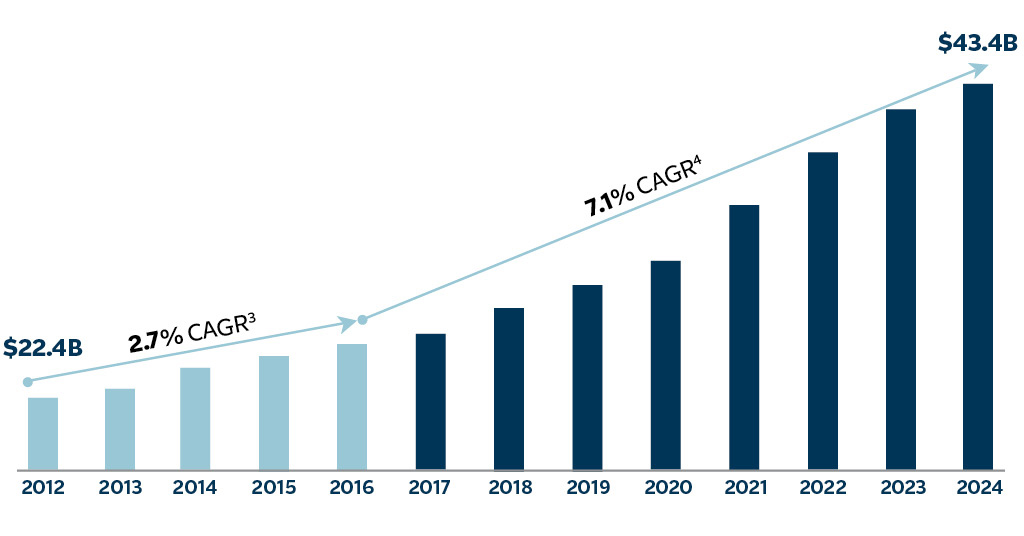

Turning to the top line, today’s production generates tomorrow’s earned premiums. In 2024, we delivered record net written premiums of $43.4 billion, up 8% compared to the prior year. This represents the 15th consecutive year of net written premium growth. All three of our business segments contributed to this strong top-line performance, with Business Insurance increasing 8%, Bond & Specialty Insurance increasing 7% and Personal Insurance increasing 8%. This growth has been part of a deliberate strategy we developed in 2016 to profitably improve our growth trajectory. We seek to achieve profitable growth not by competing on price but by investing in franchise value – making sure that we offer the products, services and experiences that our customers want to buy and our distribution partners want to sell.

Also central to our growth strategy is our very granular approach to risk selection, underwriting and pricing. As a result of that approach, and investments we have made over decades in leading data and analytics, our growth in insured exposures correlates to returns. In other words, generally speaking, the more attractive the returns in a business, the more we have been growing insured exposures in that business. Conversely, where returns have not met our target, we have grown by pricing accordingly. All of which is to say, Travelers’ unique combination of franchise value and execution yields high-quality, profitable growth.

Investment expertise

We strive to be thoughtful underwriters on both sides of the balance sheet, and we have always managed our investment portfolio to support our insurance operations, not the other way around. Accordingly, our investment portfolio is positioned to meet our obligations to policyholders under almost every foreseeable circumstance – anything from a global pandemic to a significant natural disaster to a financial crisis. With this in mind, we are focused on risk-adjusted returns and credit quality rather than reaching for yield that is not commensurate with the underlying risk.

Our well-defined and consistent investment portfolio has been a meaningful and reliable contributor to our results, year in and year out. This is exactly what we saw in 2024. Net investment income from our fixed income and alternative investment portfolios increased by more than 21% to a very strong $3 billion after-tax. From a fixed income perspective, net investment income benefitted from very strong top-line growth and record cash flow from operations, as well as from slightly higher average interest rates.

Underwriting expertise

Underwriting excellence is, of course, key to our success, and there is nothing more critical to underwriting excellence than a culture that values strong performance over time and understands how to balance the art and science of decision making based on data and analytics. In other words, evaluating risk and reward is at the heart of what we do. In that regard, our culture alone is a significant competitive advantage, and one that we believe is very hard to replicate. A critical component of this culture is our granular approach to underwriting. In our commercial businesses, that means execution on an account-by-account or class-by-class basis. In personal lines, it means a very high degree of segmentation by risk profile, product and geography. With that and our advanced data and analytics, we thoughtfully select the risks that we write and price our products deliberately with our target return in mind.

Like every aspect of our business, our focus on performance over time is core to how we manage our catastrophe exposure. Although we are unable to predict what the next event will be or where it will occur, we are taking steps every day to ensure that our portfolio of risk properly contemplates the potential for loss and that we maintain the right balance of risk and reward. While the impact of the risk-based decisions that we are making today is not always immediately evident, those decisions will continue to drive our performance over time. Due to our thoughtful approach to catastrophe management, our share of catastrophe losses this year and over time has been significantly favorable relative to our market share. This outperformance is the result of our prudent and integrated approach to managing our catastrophe exposures through portfolio, risk selection, underwriting and pricing actions. We continue to make significant investments in advanced capabilities to ensure that our catastrophe management teams and underwriters have the tools and insights necessary to develop a comprehensive view of catastrophe risk. We believe that these investments position Travelers to continue to outperform over time.

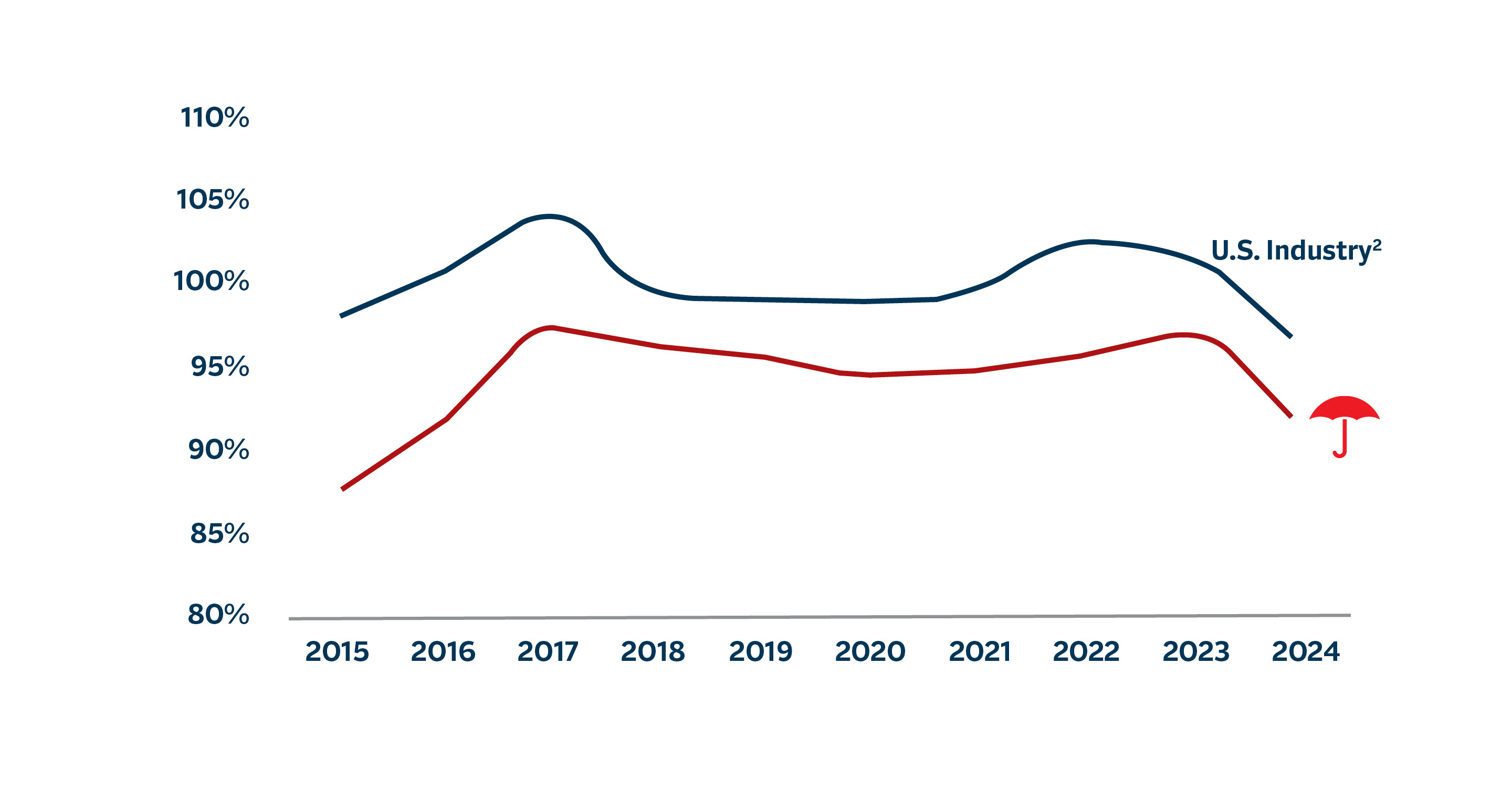

Combined ratio2 – Travelers in comparison to the U.S. industry

Line chart displaying Travelers in comparison to the U.S. Industry. According to S&P Global Market Intelligence, Travelers’ Statutory Combined Ratio has compared favorably to the U.S. industry average from 2015 to 2024. Used with permission.

2 Statutory Combined Ratio. Copyright © 2025, S&P Global Market Intelligence. Used with permission. NAIC filing for both U.S. Industry and Travelers.

Travelers’ powerful earnings engine

Any strategy to deliver a leading return on equity over time requires a strategy to grow over time. To that end, we have laid out a strategy to achieve profitable growth in the context of the forces of change impacting our industry – namely, changing consumer expectations, emerging technology trends, more sophisticated data and analytics, and evolving distribution models.

Strong underwriting is the flywheel that sets it all in motion. Thanks to exceptional franchise value and excellent marketplace execution, we have profitably grown our premium base by more than 70% since 2016, from $25 billion to more than $43 billion today. Our reported and underlying profitability significantly improved over that period of time. Our growth has been largely organic, from products in which we have deep expertise, through distribution partners with whom we have long-standing relationships, and in geographies where we have a thorough understanding of the regulatory environment and other market dynamics – in other words, a relatively low-risk growth strategy. As we have grown our business, we have also successfully executed on our strategic initiative to improve productivity and efficiency.

It is a virtuous cycle, one in which the combination of well-conceived and executed strategic initiatives, an effective capital management strategy and a thoughtful investment strategy contributes to attractive returns and growth in adjusted book value per share. The successful execution of this strategy over time has led to significantly higher underlying underwriting income, meaningfully higher cash flow from operations and growth in our investment portfolio.

The tremendous strength and relative predictability of our underlying underwriting income have increasingly contributed to our bottom line. Our underlying underwriting income has more than tripled over the last eight years, reaching $4.5 billion after-tax in 2024. This level of underlying underwriting income positions us to deliver strong income and returns, even with the level of outsized natural catastrophes that we and the industry experienced in 2024.

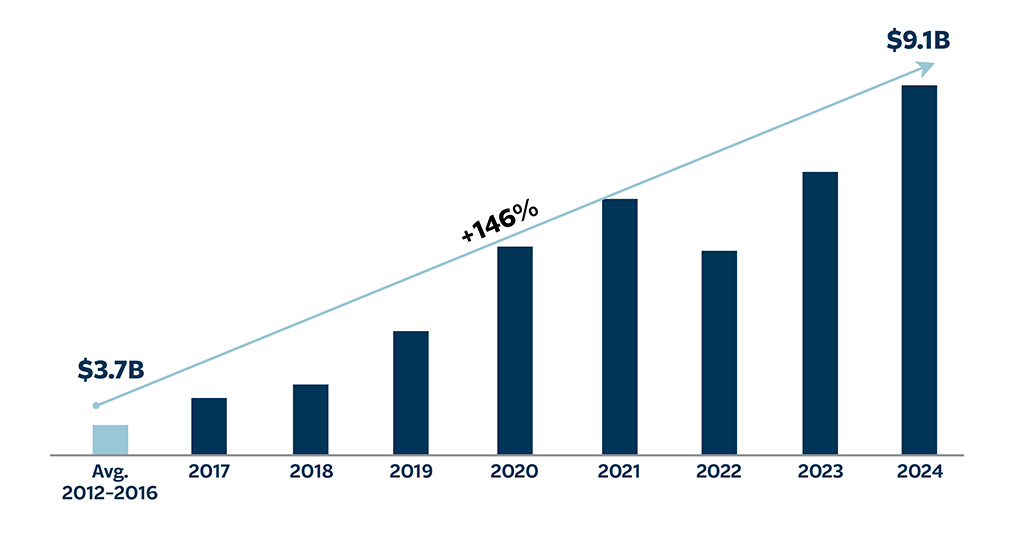

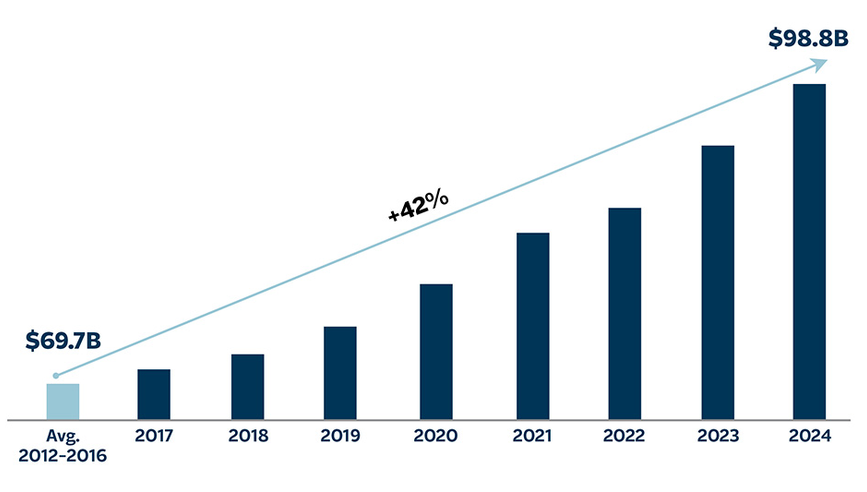

Our growth in underwriting income also contributes to the increase in our cash flow from operations. Since 2016, we have more than doubled our annual cash flow from operations to a record $9.1 billion in 2024. Cash flow is not a measure that we or the industry talk a lot about, but it is important. Cash flow is what enables us to make strategic investments in our business, return excess capital to shareholders and grow our investment portfolio. Since 2016, we have invested $12 billion in technology (with a steadily increasing allocation to important strategic initiatives), returned more than $20 billion of excess capital to our shareholders and grown our investment portfolio, excluding unrealized investment gains (losses), by $30 billion to almost $100 billion. Importantly, our growing investment portfolio positions us to continue generating a higher level of predictable and reliable net investment income.

Accelerating net written premium growth

Bar chart displaying Accelerating Net Written Premium Growth from 2012 through 2024, showing an increase from $22.4 billion in 2012 to $43.4 billion in 2024. Compound annual growth rate (CAGR) from 2012 through 2016 was 2.7%, and from 2016 through 2024 was 7.1%.

3 Represents growth from 2012 through 2016.

4 Represents growth from 2016 through 2024.

Consistently strong underlying profitability5

Bar chart displaying Consistently Strong Underlying Profitability from 2012 through 2024. In 2024, the underlying underwriting combined ratio was 86.2%. In 2012, the underlying underwriting combined ratio was 93.0%. The average across 2012 to 2024 was 91.0%. This data excludes the impact of catastrophe losses and prior year reserve development.

5 Underlying underwriting combined ratio, which excludes the impact of catastrophe losses and net prior year reserve development.

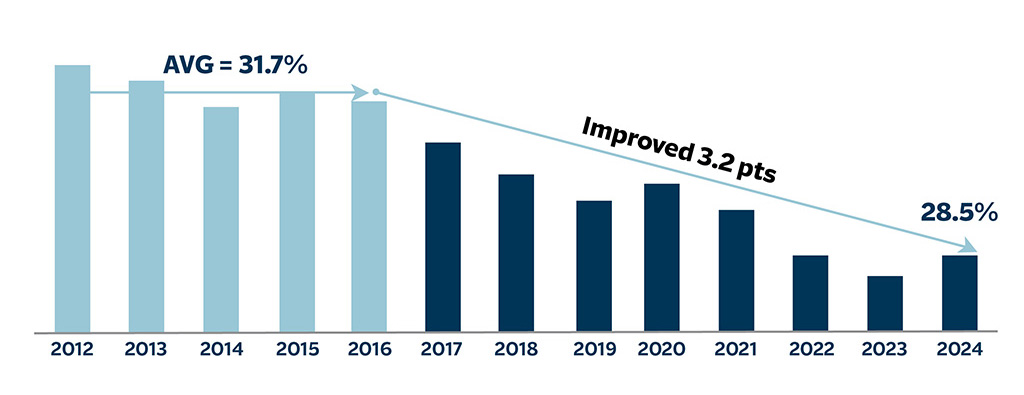

Improving expense ratio

Bar chart displaying Improving Expense Ratio from 2012 through 2024. The average from 2012 through 2016 was 31.7%. The ratio improved 3.2 points from the average to 28.5% in 2024.

Higher underlying underwriting income6 (after-tax)

Chart displaying Higher Underlying Underwriting Income after-tax from 2012 through 2024. The increase from 2012 through 2024 was 246%, representing an increase from an average of $1.3 billion from 2012 to 2016, to $4.5 billion in 2024. This data excludes the impact of net prior year reserve development and catastrophe losses.

6 Underlying underwriting income, which excludes the impact of net prior year reserve development and catastrophe losses.

Higher cash flow from operations

Bar chart displaying Higher Cash Flow from Operations from 2012 through 2024. The increase from 2012 through 2024 was 146%, representing an increase from an average of $3.7 billion between 2012 to 2016, to $9.1 billion in 2024.

Growing invested assets7

Bar chart displaying Growing Invested Assets from 2012 through 2024. The increase from 2012 through 2024 was 42%, representing an increase from an average of $69.7 billion between 2012 to 2016, to $98.8 billion in 2024. Invested assets excludes net unrealized investment gains (losses).

7 Invested assets excludes net unrealized investment gains (losses).

Consistent and successful long-term financial strategy delivers shareholder value

It is always important to consider our financial results and strategic initiatives in the context of what we are ultimately trying to achieve. At Travelers, our simple and unwavering mission for creating shareholder value is to:

- Deliver superior returns on equity by leveraging our competitive advantages.

- Generate earnings and capital substantially in excess of our growth needs.

- Thoughtfully rightsize capital and grow book value per share over time.

The results we deliver are due to our deliberate and consistent approach to creating shareholder value. We have been clear for many years that one of our crucial responsibilities is to produce an appropriate return on equity for our shareholders. This has meant developing and executing financial and operational plans consistent with our goal of achieving superior returns, which we defined many years ago as a mid-teens core return on equity over time. We emphasize that this objective is measured over time because we recognize that the macroeconomic environment, loss cost trends, weather, and geopolitical and other factors impact our results from year to year, and that there will be years – or longer periods – and environments in which a return below mid-teens is industry leading.

Our 2024 return on equity of 19.2% and core return on equity of 17.2% again meaningfully exceeded the average return on equity for the domestic P&C industry of 13.3%, according to estimates from Conning, Inc., a global investment management firm and insurance research provider. As shown in the chart below, our return on equity has significantly outperformed the average return on equity for the industry in each of the past 10 years. Importantly, these industry-leading returns on an absolute basis are even more impressive on a risk-adjusted basis when you take into account our low level of volatility. The level and consistency of our return on equity over time, particularly in the context of the growth we have achieved, reflect the value of our competitive advantages and the discipline with which we run our business.

Return on equity

Line graph displaying Return on Equity for Travelers compared to U.S. P&C Insurers. Travelers is at 19.2% in 2024, compared to U.S. P&C Insurers at 13.3%. Travelers’ return on equity exceeds the average return on equity for the industry in each of the past 10 years. The 2024 Forecast is sourced from Conning, Inc., used with permission. S&P historical data used with permission.

8 2024 Forecast: © 2025 Conning, Inc., as published in Conning’s Property-Casualty Forecast & Analysis by Line of Insurance, 2024 Q4 edition. Used with permission. Historical data: © 2025 S&P Global Market Intelligence LLC. Used with permission.

A balanced approach to rightsizing capital

The successful execution of our financial strategy, together with our fortress balance sheet, has enabled us to grow both book value per share and adjusted book value per share consistently over the last 10 years.

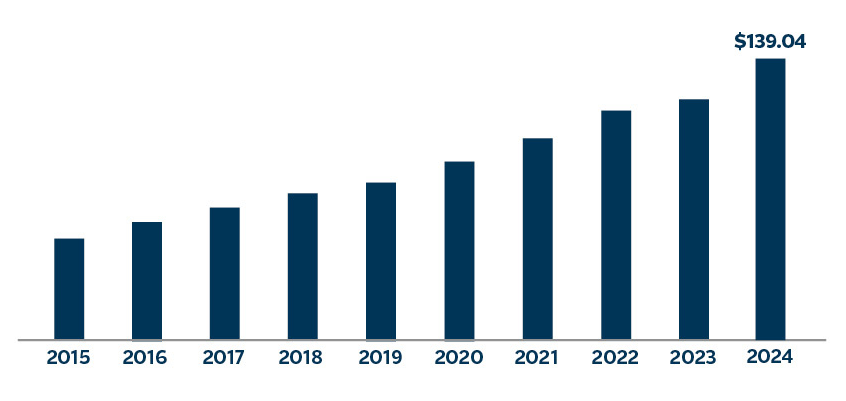

Adjusted book value per share9

Bar chart displaying Adjusted Book Value per Share steadily increasing from 2015 through 2024. In 2024, the value was $139.04. This chart excludes net unrealized investment gains (losses), net of tax, included in shareholders’ equity.

9 Excludes net unrealized investment gains (losses), net of tax, included in shareholders’ equity.

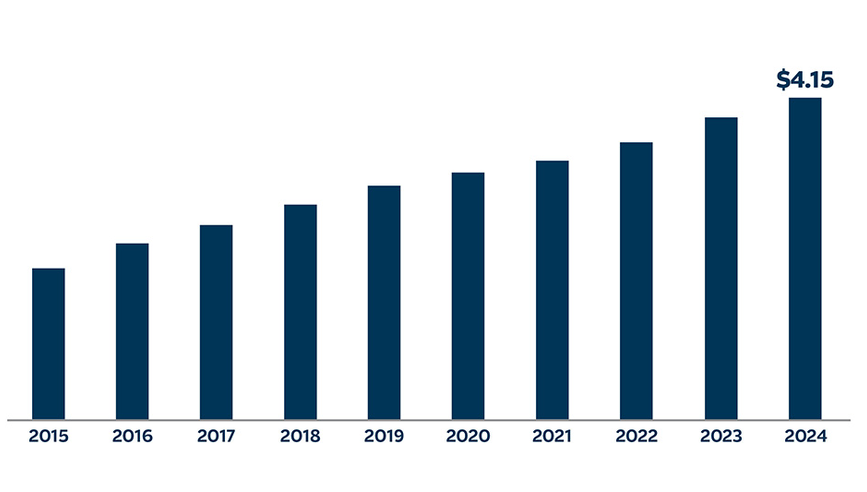

During this period, we have also returned a significant amount of excess capital to our shareholders through dividends and share repurchases. Over the last 10 years, we have increased our dividend each year.

Dividends per share

Bar chart displaying Dividends per Share steadily increasing each year from 2015 through 2024. In 2024, dividends per share were $4.15.

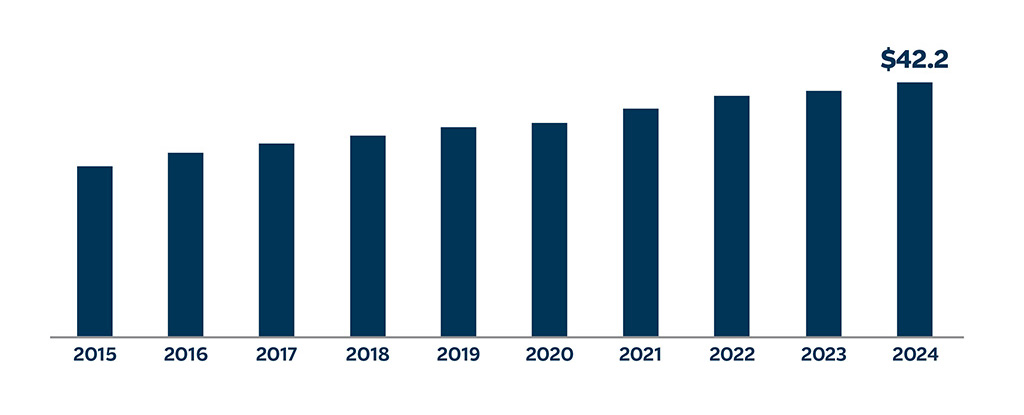

Notably, since we began our share repurchase program in 2006, we have returned approximately $57 billion of excess capital to our shareholders, including through $42 billion of share repurchases – well in excess of the market capitalization of the company when we started. If you owned Travelers stock when we began our share repurchase program in 2006, your percentage ownership has more than tripled. This percentage increase is even higher if you participated in our dividend reinvestment program. Over that same period, we have increased our dividend at an average annual rate of more than 8%.

Cumulative share repurchases (since 2006)

($ in billions)

Bar chart displaying Cumulative Share Repurchases steadily increasing each year since 2006 from 2015 through 2024. In 2024, cumulative share repurchases were $42.2 billion.

Our capital management strategy has been an important driver of shareholder value creation over time. Our first objective for the capital we generate is to reinvest it in our business – organically and inorganically – to create shareholder value. For example, as we continue to grow our top line, as we have meaningfully for the past few years, we will retain more capital to support that growth. Also, we continue to invest in everything from talent to technology to further our ambitious innovation agenda, advance our strategic objectives and drive tomorrow’s performance.

Having said that, we are disciplined stewards of our shareholders’ capital. To the extent that we generate capital that we cannot reinvest consistent with our objective of generating industry-leading returns over time, we will manage it in the same way we have for nearly two decades – by returning it to our shareholders through dividends and share repurchases. By returning excess capital to our investors, we give them the ability to allocate their investment dollars as they see fit, including by investing in companies with different growth profiles or capital needs, thereby efficiently allocating capital across the economy. Over time, that efficient allocation of capital in the marketplace contributes to a stronger economy.

See the Non-GAAP Reconciliations page for a discussion and calculation of non-GAAP financial measures.

More about financial performance

Financial highlights

Review our financial highlights from recent years.

Delivering value over time

The success of our strategy – with all its component parts – drives our total return to shareholders over time.

Non-GAAP reconciliations

Review tables that provide reconciliations of certain GAAP financial measures to non-GAAP financial measures.