Financial Performance: Delivering Value Over Time

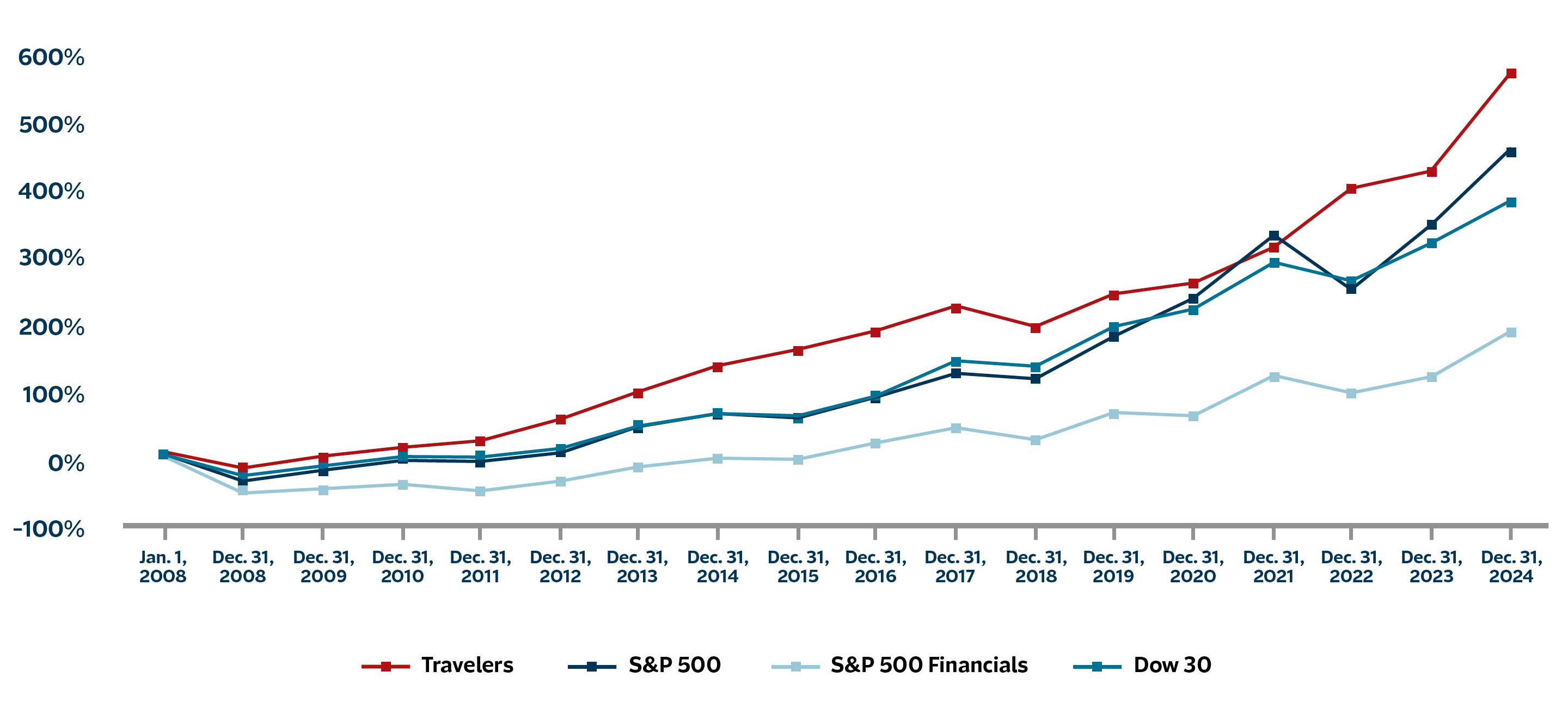

Ultimately, it is the success of our strategy – with all its component parts – that drives our total return to shareholders over time. We have a well-established track record of managing the company to create value over the long term, through periods of weather volatility; through anticipated and unanticipated developments impacting loss trends; through both foreseeable and unforeseeable economic cycles; and through any number of more extreme economic, geopolitical and other conditions. With that in mind, the graph below compares our total return to shareholders since the 2008 financial crisis to the returns for the S&P 500, the S&P 500 Financials and the Dow 30.

Total return to shareholders1

Line graph comparing Travelers’ Total Return to Shareholders to the returns for the Dow 30, S&P 500 and S&P 500 Financials between 2008 and 2024. This represents the change in stock price plus the cumulative amount of dividends, assuming dividend reinvestment. For each year on the chart, the total return is calculated with January 1, 2008, as the starting point and December 31 of the relevant year as the ending point. The graph shows returns generally increasing between 2008 and 2024.

1 Represents the change in stock price plus the cumulative amount of dividends, assuming dividend reinvestment. For each year on the chart, total return is calculated with January 1, 2008, as the starting point and December 31 of the relevant year as the ending point. © Bloomberg Finance L.P. Used with permission of Bloomberg.

Our total return reflects the successful execution of our long-term strategy. We provide our shareholders with growth in book value, industry-leading returns, low volatility and high credit quality. The success of this long-term strategy is evident in the strong performance of our stock over time, which has been remarkably consistent relative to many others in the P&C industry. Viewing our performance through this long-term lens, we are as confident as ever that executing on our long-term financial strategy, managing Travelers with an over-time discipline and continuing to invest in our competitive advantages through our ambitious and focused innovation agenda is the right approach for building on Travelers’ outstanding record.

More about financial performance

2024 results

Travelers delivered core income of $5 billion, or $21.58 of core income per diluted share, generating core return on equity of 17.2% – an exceptional result and a meaningful spread over both the 10-year Treasury and our cost of equity.

Financial highlights

Review our financial highlights from recent years.

Non-GAAP reconciliations

Review tables that provide reconciliations of certain GAAP financial measures to non-GAAP financial measures.