Company Profile

Highlight

$5.0B

of net income, an increase of more than 67% over 2023

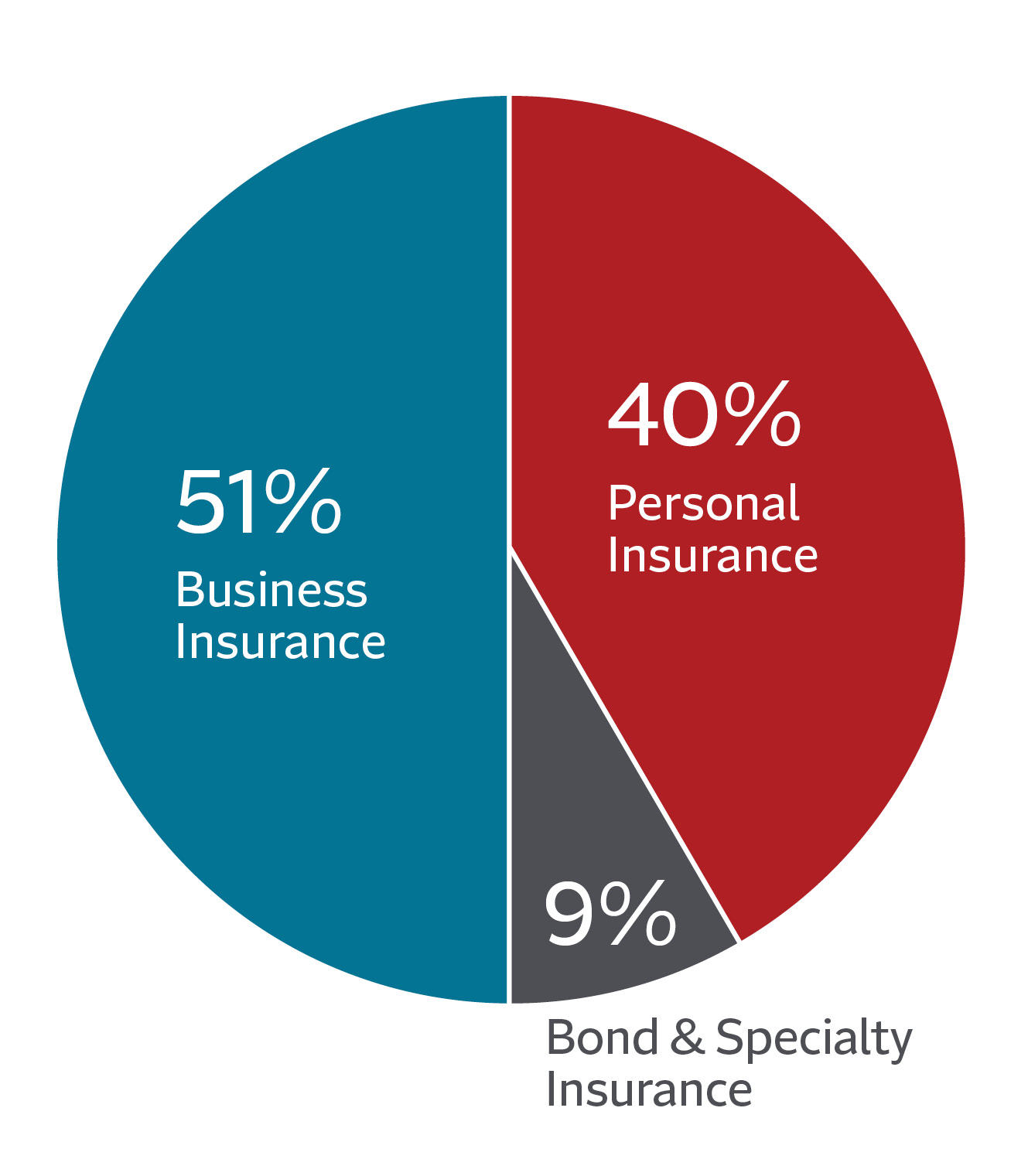

The Travelers Companies, Inc. (NYSE: TRV) is a leading provider of commercial, personal and specialty insurance products and services to businesses, government units, associations and individuals. Our diverse business lines offer our customers a wide range of coverage sold primarily through independent agents and brokers. Travelers has more than 30,000 employees and relationships with more than 12,700 independent agents and brokers in the United States, Canada, the United Kingdom and the Republic of Ireland. Travelers is the only property casualty company in the Dow Jones Industrial Average and generated revenues of approximately $46.4 billion in 2024.

Net written premiums

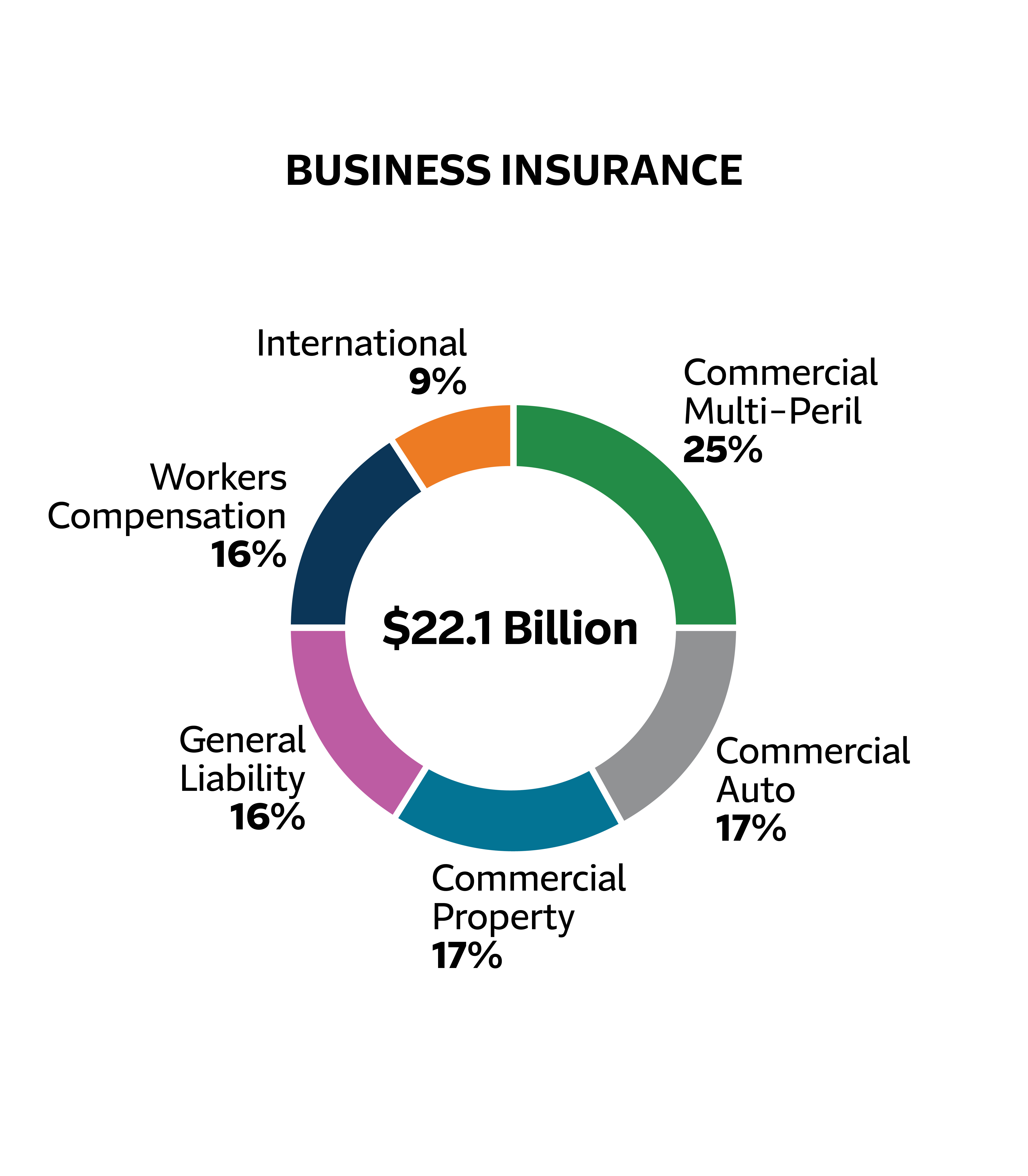

Business Insurance

Business Insurance offers a broad array of property and casualty insurance products and services to our customers, primarily in the United States, as well as in Canada,1 the United Kingdom, the Republic of Ireland and throughout other parts of the world, including as a corporate member of Lloyd’s.

A top-five writer of four major U.S. product lines, including number one in workers compensation and commercial multi-peril2

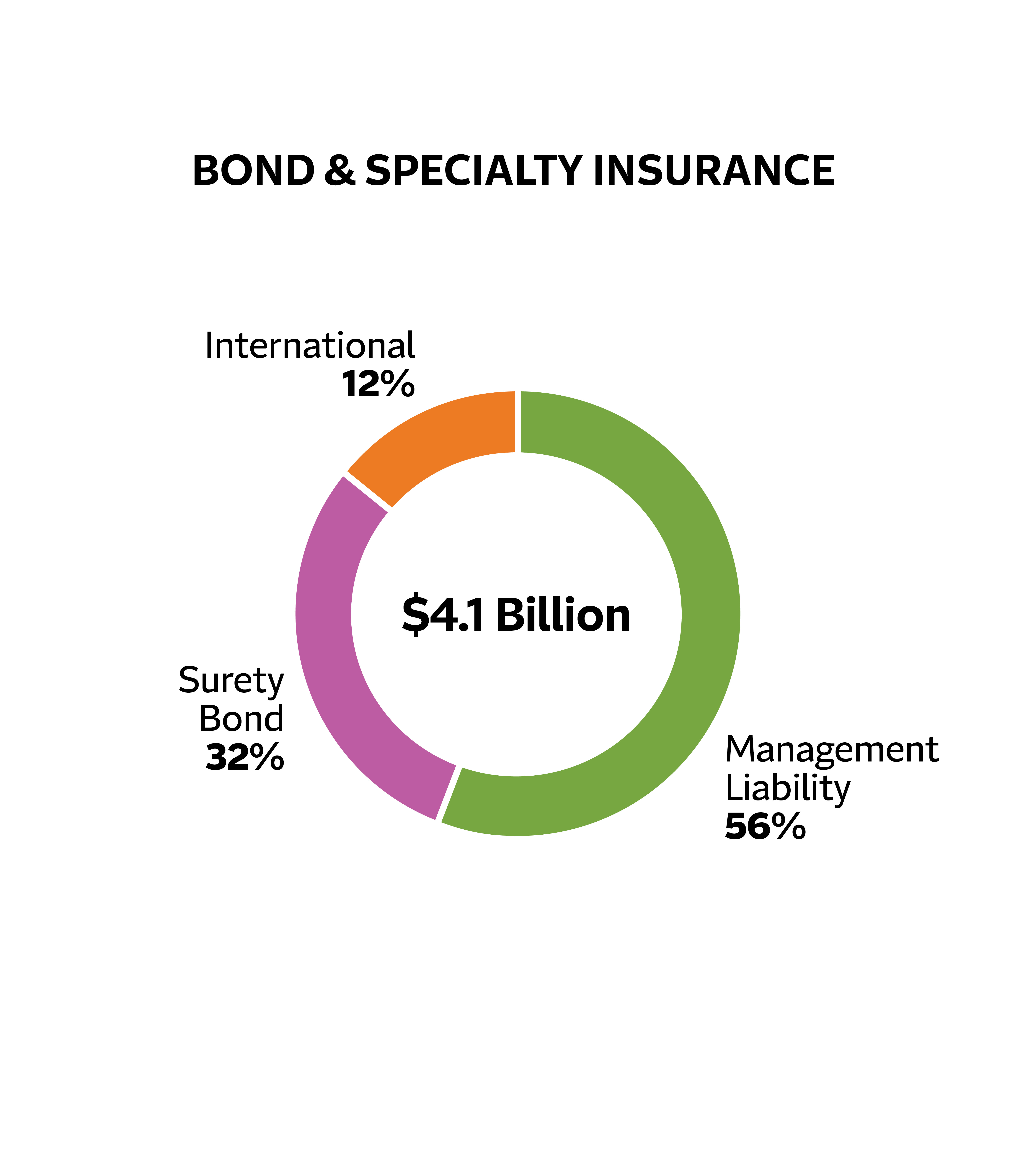

Bond & Specialty Insurance

Bond & Specialty Insurance offers surety, fidelity, management liability, professional liability, and other property and casualty coverages and related risk management services to our customers, primarily in the United States, and certain surety and specialty insurance products in Canada, the United Kingdom, the Republic of Ireland and Brazil (through a joint venture).

A top-five writer of surety and management liability in the U.S.3

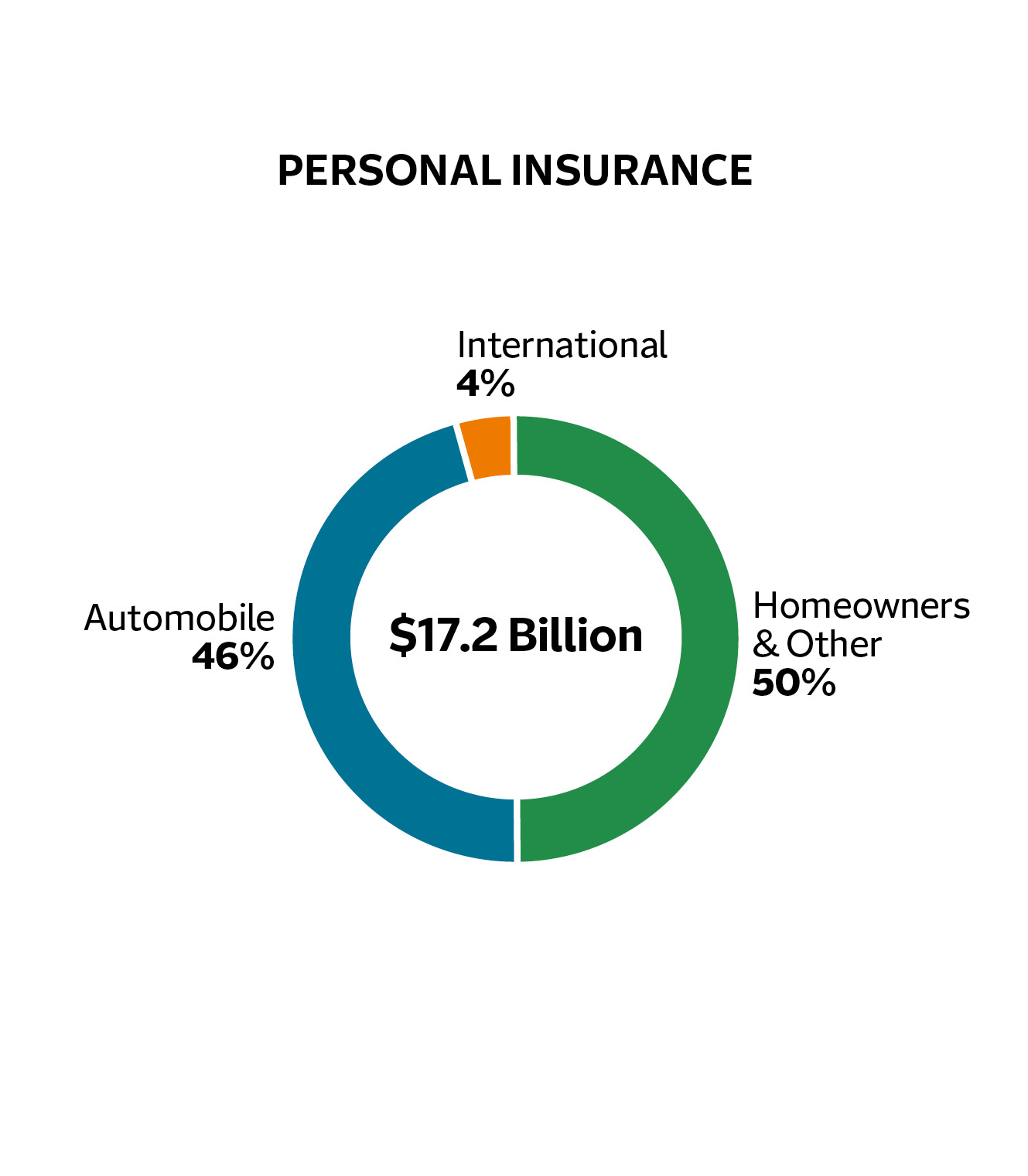

Personal Insurance

Personal Insurance offers a broad range of property and casualty insurance products and services covering individuals’ personal risks, primarily in the United States, as well as in Canada.1 Our primary products of automobile and homeowners insurance are complemented by a broad suite of related coverages.

A top-10 writer of U.S. personal automobile and homeowners insurance,4 and a leading personal insurance writer with independent agents5

1 On May 27, 2025, Travelers announced that it has signed a definitive agreement to sell the personal insurance business and the majority of the commercial insurance business of Travelers Canada to Definity Financial Corporation. The transaction is expected to close in the first quarter of 2026, subject to regulatory approvals and customary closing conditions. Travelers will retain its Canadian surety business.

2 2024 U.S. Statutory DWP. Four major product lines: Commercial Multi-Peril (Commercial Multiple Peril (Liability), Commercial Multiple Peril (Non-Liability), Farmowners Multiple Peril); Commercial Auto (Commercial Auto No-Fault (Personal Injury Protection), Commercial Auto Physical Damage, Other Commercial Auto Liability); General Liability (Other Liability Occurrence, Product Liability); and Workers Compensation. Copyright © 2025, S&P Global Market Intelligence. Used with permission.

3 2024 U.S. Statutory DWP, U.S. excluding territories. Management Liability reflects Other Liability Claims Made, Fidelity, and Burglary & Theft statutory lines. Copyright © 2025, S&P Global Market Intelligence. Used with permission.

4 2024 U.S. Statutory DWP. Copyright © 2025, S&P Global Market Intelligence. Used with permission.

5 2023 U.S. Statutory DWP. Copyright © A.M. Best Company, Inc. Used with permission.

2024 net written premiums