Disaster Preparedness & Response

Highlight

>137,000

Catastrophe notices of loss responded to in 2024

Severe weather events and other disasters are part of our business. We take a holistic approach to managing our company’s exposure to disasters and to helping our customers prepare for, respond to and recover from catastrophic events. In addition, we play an active role in trying to influence the public policy agenda with regard to resiliency, sustainability and adaptation.

Approach

While our Risk Control department focuses on helping our customers understand and mitigate their risks, our Claim Catastrophe Response team takes the lead on customer interactions should a disaster or severe weather event occur. Our Claim Catastrophe Response team coordinates closely with multiple business units and functions across the organization, including Underwriting, Legal and Communications, to respond to our customers’ needs in a quick, efficient and compassionate manner. That is a core part of the Travelers Promise to take care of the people we are privileged to serve.

Our promise to help customers in the face of disasters begins well before a catastrophe hits. We partner with our customers and communities to help ensure they are prepared for a disaster, and we employ leading-edge data and analytics capabilities to help predict extreme events. In the event of a catastrophe, we leverage innovative technologies, the power of our data and analytics, and our more than 30,000 in-house employees to provide the best possible outcomes for our affected customers.

More about disaster preparedness & response

Partner in preparedness

We offer a range of resources that help our customers and the public prepare for disasters.

Leading analytical capabilities in disaster response

As part of our efforts to respond to our customers’ needs in a quick, efficient and compassionate manner after a disaster or extreme weather event, we seek to further develop and leverage our leading analytical capabilities.

Dedicated catastrophe response resources

Our sustained investment in innovative catastrophe response strategies sets Travelers apart from our peers.

Customer outcomes

Despite the added logistical difficulties inherent in catastrophe (CAT) response, our CAT claim performance consistently meets or exceeds our internal benchmarks for claim handling.

Illustrative initiatives

National Catastrophe Center

Catastrophe Planning and Response

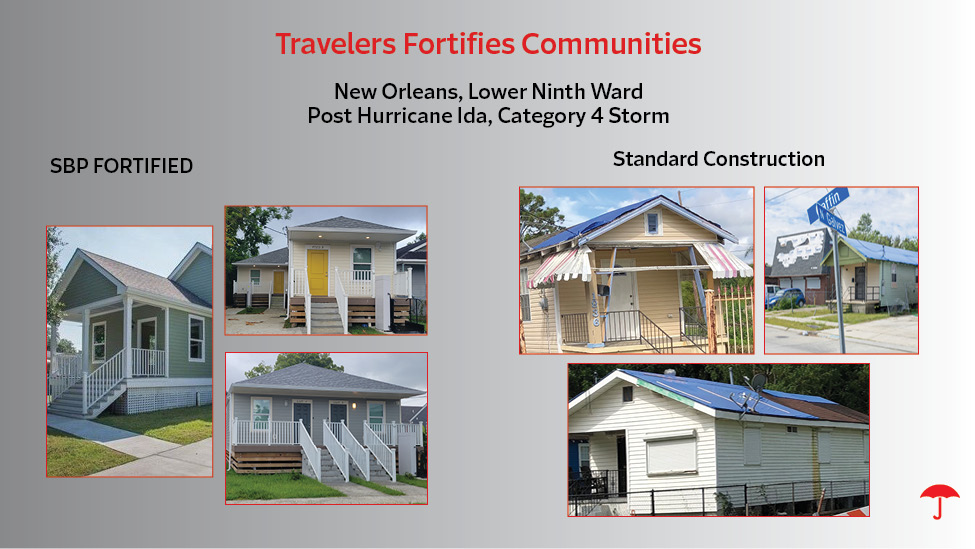

Travelers Fortifies Communities

Building Strong, Resilient Communities

Wildfire Defense Services

Protecting Our Customers from Increased Wildfire Risk

IBHS Sponsorship

Supporting Research in Severe Weather Readiness and Response

Travelers Institute®

Thought Leadership on Disaster Preparedness