Climate Strategy

Highlight

20%

Compound annual growth rate of our Global Renewable Energy Practice since 2018, with revenue up more than 200% over that same period

Our property and casualty insurance operations expose us to claims arising out of catastrophes in each of the geographies where we write business and to varying peak catastrophe perils in different countries and regions. Severe weather events over the last two decades have underscored the unpredictability of climate trends. For example, the frequency and/or severity of hurricane, tornado, hail and wildfire events in the United States have been more volatile during this time period. The insurance industry has experienced increased catastrophe losses due to a number of factors, including, in addition to weather/climate variability, aging infrastructure, more people living in, and moving to, high-risk areas, population growth in areas with weaker enforcement of building codes, urban expansion, an increase in the number of amenities included in, and the average size of, a home and higher inflation, including as a result of post-event demand surge. We believe that changing climate conditions have also likely added to the frequency and severity of natural disasters and created additional uncertainty as to future trends and exposures. Our approach to climate-related risks and opportunities is multifaceted, and we believe it allows us to mitigate our exposure to climate-related risk and provide products and services that both help our customers mitigate those risks and meet our long-term financial objectives. As part of our comprehensive climate strategy, we also advocate for and support community resiliency, mitigation and disaster preparedness efforts.

Approach

As a core part of our business, we continually monitor, assess and respond to the risks and opportunities posed by changing climate conditions to provide products and services that both help our customers mitigate associated risks and are priced to meet our long-term financial objectives. We also regularly consider new insurance products and services that could be useful to our customers in addressing their climate-related risks. This section introduces our approach to managing changing climate conditions, which we expand on in a detailed report that aligns with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). To read about environmental efforts within our operations, refer to the Eco-Efficient Operations section.

Board oversight and governance

The Board of Directors plays an important role in overseeing our Enterprise Risk Management (ERM) practices and strategies, including our company’s evaluation of potential risks relating to changing climate conditions. The Risk Committee of the Board, composed of independent directors, is responsible for oversight of the strategies, processes and controls relating to risks in our business operations, including insurance underwriting and claims, reinsurance, catastrophe exposure and the impact of changing climate conditions on those operations. The Board Risk Committee assists the full Board in overseeing the operational activities of the company and the identification and review of risks that could have a material impact on Travelers, including risks related to changing climate conditions.

The Board Risk Committee meets on a quarterly basis with the Chief Risk Officer, Chief Underwriting Officer, members of the Enterprise Risk Committee and, as appropriate, other members of senior management to discuss risks that could have a material impact on Travelers, including risks related to changing climate conditions. These discussions include, for example, information regarding historical loss experience, loss trend projections, lessons learned from recent catastrophe events, underwriting practices and market share analyses. Among other things, these discussions focus on Travelers’ underwriting risk management approach in light of catastrophe volatility, the potential impact of climate-related perils to Travelers and its customers and strategies for mitigating climate-related risks. These discussions inform, among other things, the company’s financial plan, risk appetite and underwriting approach. The Board Risk Committee, in turn, reports to the full Board with regard to its discussions.

A senior executive team, which includes the Chief Risk Officer and the Chief Underwriting Officer, oversees the ERM process and is responsible for facilitating discussions with the Board Risk Committee. Our management-level Enterprise, Segment and Business Resiliency Risk Committees are key elements of our ERM structure and help reinforce our strong culture of risk management, including with respect to changing climate conditions. Discussions regarding potential risks (and opportunities) related to energy, the environment and changing climate conditions are supported by various committees and groups, including the Property Catastrophe Management Committee, the Sustainability Committee, the Casualty Emerging Risk Committee and the Travelers Global Energy Council, among others. These committees and groups, including the ERM group, coordinate and support climate-related initiatives and strategies across Travelers and are venues to share information and leverage expertise.

Our Chief Sustainability Officer leads Travelers’ environmental, social and governance (ESG) efforts across the organization, chairs the company’s multidisciplinary Sustainability Committee and is a member of the company’s Disclosure Committee. Our Chief Sustainability Officer also works with our ERM department to ensure that identification and assessment of ESG risks are appropriately integrated into our ERM program.

Travelers provides detailed climate-related disclosures through voluntary reporting, such as our TCFD Report, as well as mandatory submissions, such as those required by the National Association of Insurance Commissioners (NAIC). Readers are encouraged to review our TCFD Report to gain a more complete understanding of our approach to addressing the risks and opportunities related to changing climate conditions.

More about climate strategy

Risk identification & management

The Segment Risk Committees are involved in identifying climate-related underwriting risks and climate-related opportunities in our book of business.

Underwriting strategy

For both property and casualty lines of business, we consider environmental factors, including weather trends and patterns, alongside other relevant risk variables in our underwriting evaluation process and in our underwriting strategies.

Catastrophe & weather models

Travelers uses various analyses and methods to evaluate our climate-related risks and make underwriting, pricing and reinsurance decisions designed to manage the company’s exposure to catastrophe events.

Products & services

As renewable energy businesses continue to innovate and expand, Travelers is playing a critical role in supporting the transition over time to a lower-carbon economy, both in the United States and internationally – specifically, through our insurance products and services designed for these innovative companies.

Resilient communities

As part of an ongoing effort to enhance public awareness about the need for effective adaptation strategies to reduce losses related to natural disasters, Travelers supports and participates in research, advocacy and education.

Illustrative initiatives

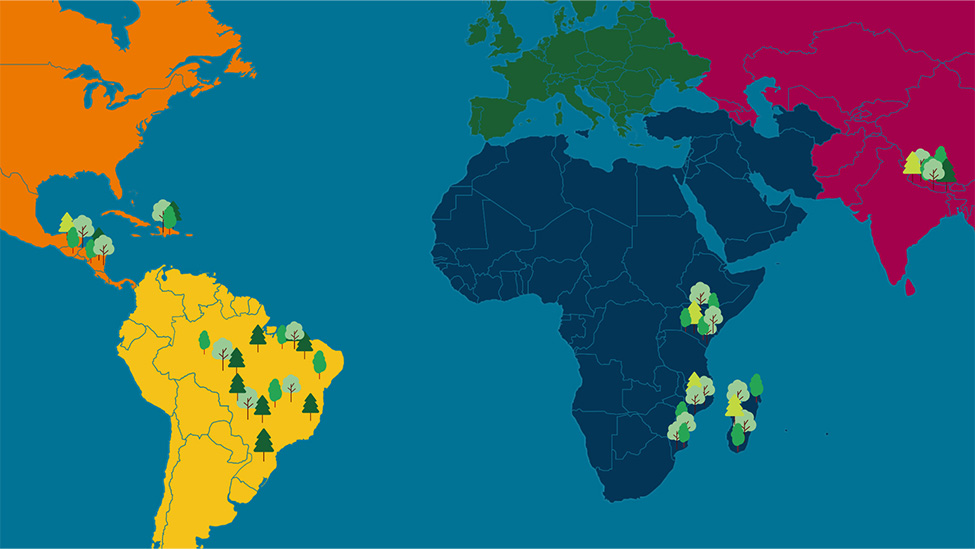

Environmental Initiatives in Europe

Growing the Travelers Europe Forest

IBHS Sponsorship

Supporting Research in Severe Weather Readiness and Response

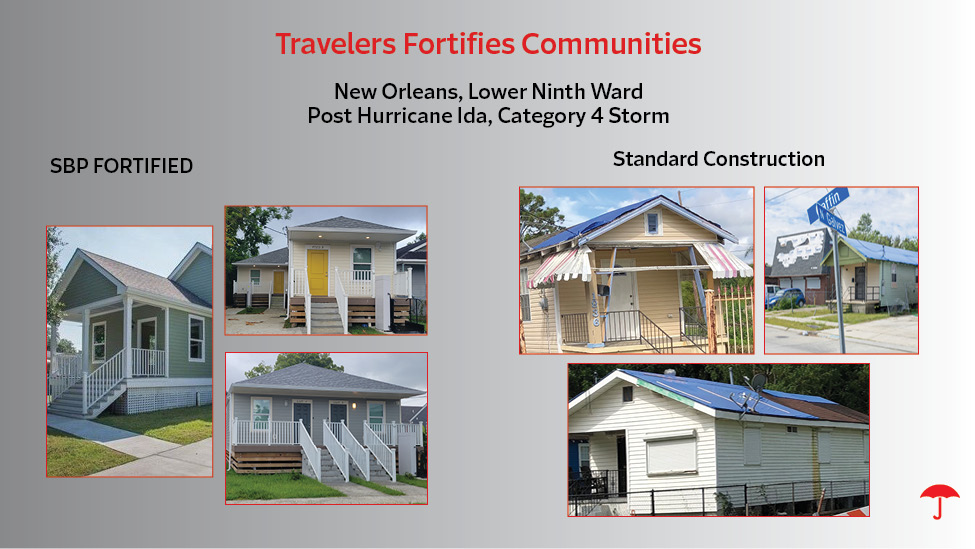

Travelers Fortifies Communities

Building Strong, Resilient Communities

Travelers Institute®

Thought Leadership on Disaster Preparedness

Wildfire Defense Services

Protecting Our Customers from Increased Wildfire Risk