Climate Strategy: Risk Identification & Management

The Segment Risk Committees are involved in identifying climate-related underwriting risks and climate-related opportunities in our book of business in collaboration with our ERM function in the United States, Canada and the United Kingdom, including the Catastrophe Risk Management and Enterprise Underwriting groups; our business underwriting groups across the company; our Risk Control function; and the Investment, Legal and Regulatory functional areas. These groups and committees stay current on climate-related and environmental risks, including through industry publications and external conferences, and actively monitor various relevant factors, such as:

- Climate-related litigation and novel theories of liability.

- Legal and regulatory requirements impacting climate, energy and the environment.

- Market-based policies that put a price on greenhouse gases, such as carbon pricing or cap-and-trade programs.

- Efforts by states, nations and nongovernmental organizations to adopt policies or implement programs designed to reduce emissions impacting global temperatures.

- Emerging regulatory requirements and “best practice guides” for international businesses with respect to risk management, disclosure and scenario analysis practices relating to changing climate conditions.

- Impacts related to emerging “clean” or “green” energy and technology trends and products.

These groups and committees are also updated from time to time by internal subject matter experts regarding emerging scientific analyses and published reports relating to weather trends and the effects of changing climate conditions. The majority of these publications focus on forward-looking impacts. These publications include:

- Materials issued by the U.N. Intergovernmental Panel on Climate Change.

- The National Climate Assessment Reports issued in the United States by the National Oceanic and Atmospheric Administration as part of the U.S. Global Change Research Program.

- Articles published in scientific journals.

When a potential risk is identified, these groups and committees engage in a comprehensive review to evaluate the risk. This process involves the relevant internal stakeholder groups and, as appropriate, may be elevated pursuant to our ERM framework for discussion with senior management and the Board of Directors. To read more about our ERM activities, refer to the Capital & Risk Management section.

Risk control & mitigation

Climate trends, which manifest over long periods of time, provide a long-term opportunity for our Risk Control department to offer and develop services to help current and potential customers mitigate the risks associated with changing climate conditions. For example, to help mitigate and minimize property losses caused by severe weather-related events, Travelers Risk Control has developed a comprehensive framework of technical planning resources to assist customers with conducting business impact analyses to prioritize and implement risk management action plans and physical improvements. Risk Control monitors events and claim trends and partners with associations such as the Insurance Institute for Business & Home Safety (IBHS) to assess innovative building products and new technologies designed to minimize wind, hail, flood and wildfire exposures. This deep domain expertise allows us to help customers improve their resiliency over time.

In addition, our Risk Control professionals can provide guidance about associated risks to our customers who have incorporated “green” products or systems to help reduce their carbon emissions and/or increase environmental sustainability. These products and systems include, for example, solar panels on residential and commercial rooftops, lithium-ion batteries used to store solar energy and vegetative roofs on commercial buildings.

Travelers Risk Control maintains technical committee memberships on the National Fire Protection Association Standards, the UL Solutions Fire Council, the Fire Protection Research Foundation’s Property Insurance Research Group, the Organization of Scientific Area Committees for Forensic Science Standards and other associations to help us research and evaluate the reliability and fire safety of “green” products and systems to determine how these products and systems impact fire, structural and safety exposures. This knowledge is used to continually update our views and empowers our Risk Control professionals to help our customers mitigate the risks associated with changing climate conditions and “green” trends, with a goal of improving outcomes while strengthening customer relationships. To learn more about some of our other products and services related to climate strategy, refer to the Products & Services portion of this section.

At Travelers, we strive to lead by example and incorporate climate-related risk mitigation measures into our own operations. To read about environmental and climate-related risk mitigation efforts within our operations, refer to the Eco-Efficient Operations section.

More about climate strategy

Approach

As a core part of our business, we continually monitor, assess and respond to the risks and opportunities posed by changing climate conditions to provide products and services that both help our customers mitigate associated risks and are priced to meet our long-term financial objectives.

Underwriting strategy

For both property and casualty lines of business, we consider environmental factors, including weather trends and patterns, alongside other relevant risk variables in our underwriting evaluation process and in our underwriting strategies.

Catastrophe & weather models

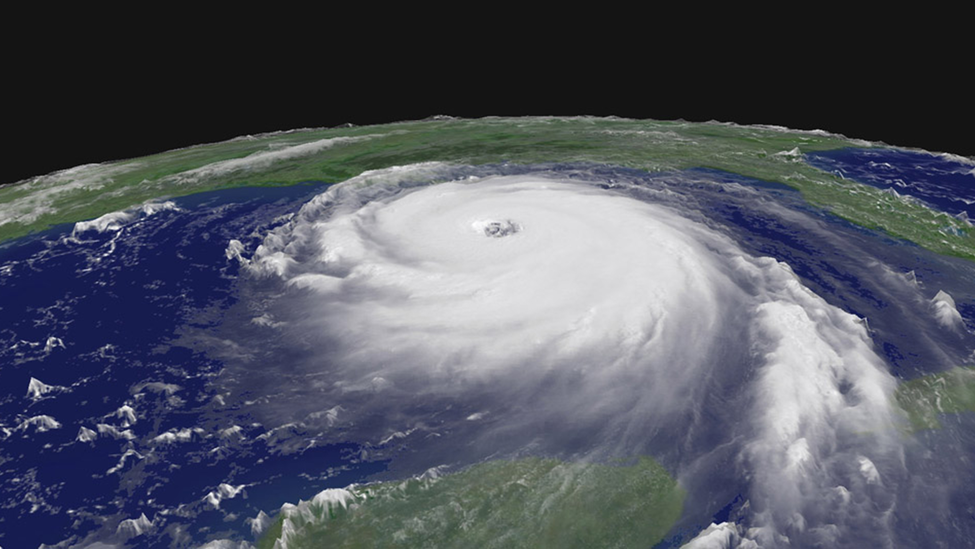

Travelers uses various analyses and methods to evaluate our climate-related risks and make underwriting, pricing and reinsurance decisions designed to manage the company’s exposure to catastrophe events.

Products & services

As renewable energy businesses continue to innovate and expand, Travelers is playing a critical role in supporting the transition over time to a lower-carbon economy, both in the United States and internationally – specifically, through our insurance products and services designed for these innovative companies.

Resilient communities

As part of an ongoing effort to enhance public awareness about the need for effective adaptation strategies to reduce losses related to natural disasters, Travelers supports and participates in research, advocacy and education.

Illustrative initiatives

Environmental Initiatives in Europe

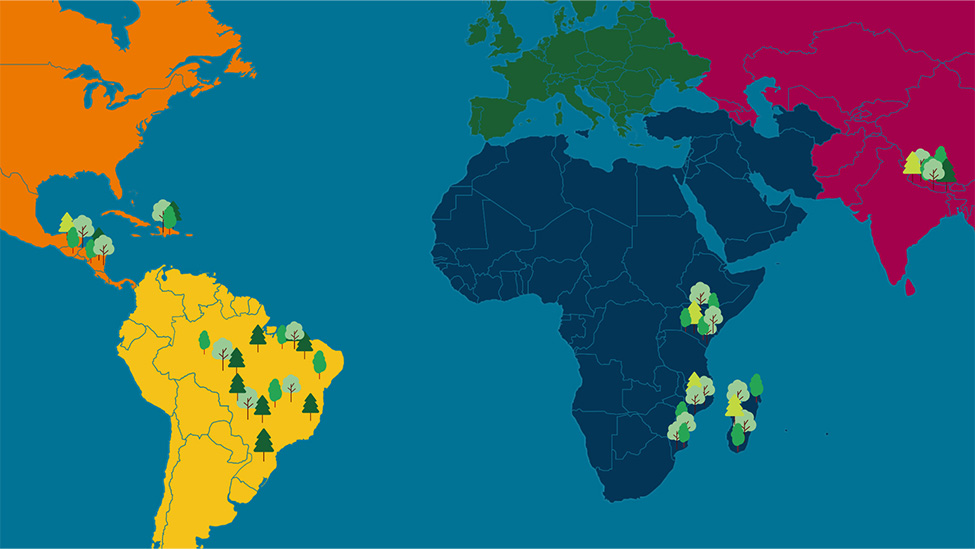

Growing the Travelers Europe Forest

IBHS Sponsorship

Supporting Research in Severe Weather Readiness and Response

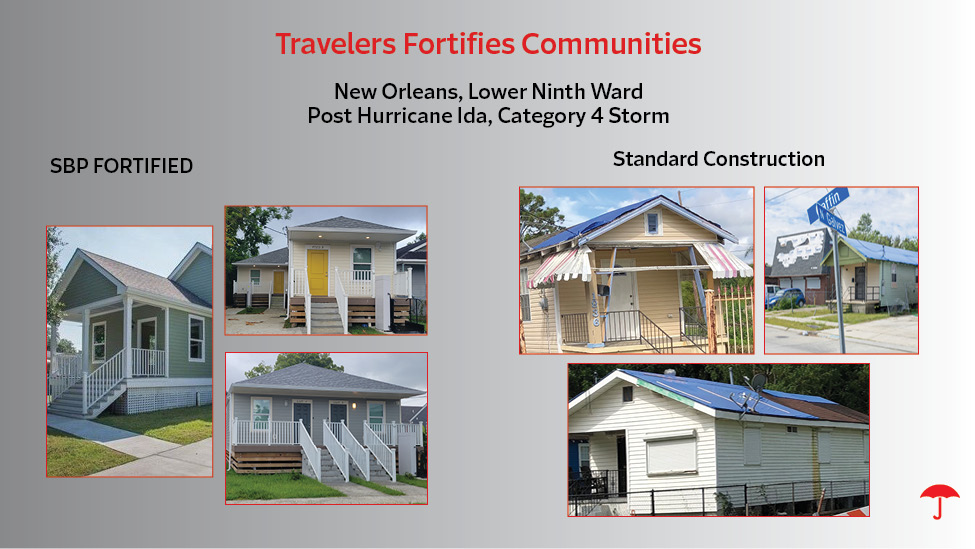

Travelers Fortifies Communities

Building Strong, Resilient Communities

Travelers Institute®

Thought Leadership on Disaster Preparedness

Wildfire Defense Services

Protecting Our Customers from Increased Wildfire Risk