Climate Strategy: Products & Services

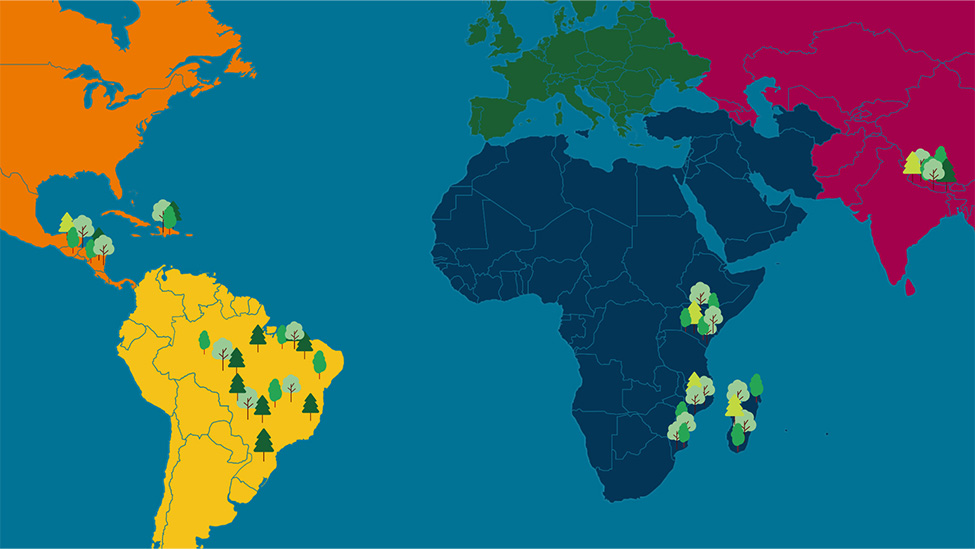

As renewable energy businesses continue to innovate and expand, Travelers is playing a critical role in supporting the transition over time to a lower-carbon economy, both in the United States and internationally – specifically, through our insurance products and services designed for these innovative companies. Travelers has been in the renewable energy space for more than 30 years and is positioned to benefit from the increased economic activity in this space by insuring more renewable energy projects globally.

Travelers offers a range of tailored insurance solutions that cover the entire life span of renewable energy businesses that invest in, develop, operate and maintain commercial and utility-scale operations – from research and development and manufacturing to permanent operations, as well as onshore and offshore wind, solar, battery energy storage and biopower operations. Our Global Renewable Energy Practice is designed to facilitate innovation and the growth of renewable energy businesses and support the over-time energy transition.

Our Global Renewable Energy Practice also helps Travelers capture a greater share of the expanding renewable energy industry domestically and internationally, as trends toward renewable and clean energy sources continue to accelerate. For example, our WindPak® and SolarPak® products respond to unique coverage issues for the wind and solar energy industries based in the United States. Through Travelers Lloyd’s Syndicate 5000, we also have broad capabilities to support large and complex wind, solar and energy storage projects that meet our risk/reward calculus across many geographies.

We continue to pursue the renewable energy sector, such as by providing coverages globally for commercial and residential solar installations and onshore and offshore wind farms, including U.S. offshore wind farm projects along the Eastern seaboard. Since we first began collecting separate data for our Global Renewable Energy Practice in 2018, the business has grown at a compound annual growth rate of 20%, with revenue up more than 200%. We also offer specialized coverage, as well as discounts where permissible, to incentivize environmentally responsible behavior – specifically, to encourage adoption of FORTIFIED Home™ construction, green buildings and hybrid/electric vehicles.

Examples of our current product offerings include the following:

- Green building coverages. A suite of green building coverages that respond to the unique coverage issues of “green” buildings and provide for the additional costs to help policyholders repair, replace or rebuild with “green” materials after a loss.

- Green home discount. A discount of up to 5% for homes that are LEED (Leadership in Energy and Environmental Design) certified.

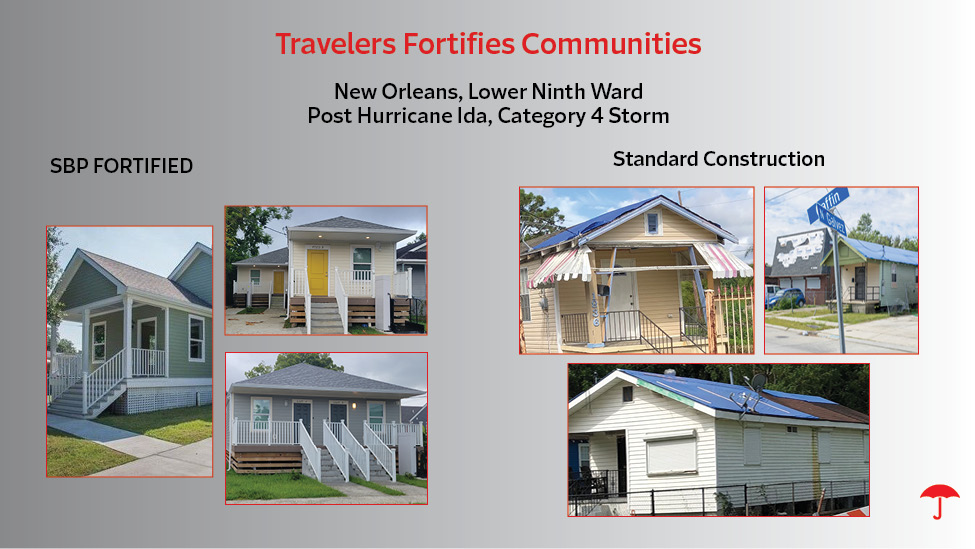

- Wind mitigation discount. In many states, our newest homeowners program offers a discount of up to 18% on hurricane premium for homes built to the Insurance Institute for Business & Home Safety FORTIFIED Gold™ standard. In Alabama, depending on the location, the discount can be up to 55% on hurricane premium for this designation. Additional discounts for wind mitigation may be available by state.

- Hybrid/electric vehicle discount. A discount for hybrid or electric vehicles – available in certain states and subject to individual eligibility.

In addition, through our Prepare & Prevent website, we provide customers, agents and brokers, and the general public with extensive educational resources to help them plan for, stay safe during and recover from natural disasters of all types. This site and the Risk Control section of MyTravelers® for Business provide customers, agents and brokers with access to nearly 2,000 resources to help them better understand risk, mitigate exposures and prevent losses.

Finally, when possible, we take steps to notify customers and agents of certain approaching natural disasters and inform them of steps they can take to help prevent damage. We also provide links to actionable prevention content on our Prepare & Prevent website. After major natural disasters, we communicate with customers and agents to inform them of steps they can take to mitigate damage, file a claim and begin the recovery process.

More about climate strategy

Approach

As a core part of our business, we continually monitor, assess and respond to the risks and opportunities posed by changing climate conditions to provide products and services that both help our customers mitigate associated risks and are priced to meet our long-term financial objectives.

Risk identification & management

The Segment Risk Committees are involved in identifying climate-related underwriting risks and climate-related opportunities in our book of business.

Underwriting strategy

For both property and casualty lines of business, we consider environmental factors, including weather trends and patterns, alongside other relevant risk variables in our underwriting evaluation process and in our underwriting strategies.

Catastrophe & weather models

Travelers uses various analyses and methods to evaluate our climate-related risks and make underwriting, pricing and reinsurance decisions designed to manage the company’s exposure to catastrophe events.

Resilient communities

As part of an ongoing effort to enhance public awareness about the need for effective adaptation strategies to reduce losses related to natural disasters, Travelers supports and participates in research, advocacy and education.

Illustrative initiatives

Environmental Initiatives in Europe

Growing the Travelers Europe Forest

IBHS Sponsorship

Supporting Research in Severe Weather Readiness and Response

Travelers Fortifies Communities

Building Strong, Resilient Communities

Travelers Institute®

Thought Leadership on Disaster Preparedness

Wildfire Defense Services

Protecting Our Customers from Increased Wildfire Risk