Capital & Risk Management

At Travelers, our Enterprise Risk Management (ERM) activities involve both the identification and assessment of a broad range of risks and the execution of coordinated strategies to effectively manage these risks. The mission of our ERM group is to facilitate risk assessment and collaborate in implementing effective risk management strategies to optimize risk and return in alignment with the company’s goals and values.

Approach

ERM at Travelers is an integral part of our business operations. The standards and practices we employ to evaluate and monitor risks are designed to enable a consistent approach to risk management across the organization. We manage our risk-taking to be within our risk appetite in a prudent and balanced manner to create and preserve value for all of the company’s stakeholders. ERM also includes an evaluation of the company’s risk capital needs, which takes into account regulatory requirements, financial strength and credit rating considerations, among economic and other factors.

A senior executive team, which includes the company’s Chief Risk Officer and Chief Underwriting Officer, oversees the ERM process. This team facilitates risk assessments and collaborates with others throughout the enterprise, including risk owners across the organization and senior leaders, to implement effective risk management strategies for Travelers. In addition, our ERM group collaborates with the company’s Chief Sustainability Officer to ensure that identification and assessment of relevant environmental, social and governance risks are appropriately integrated into our ERM framework. The ERM group also uses third-party modeling processes to evaluate capital adequacy. These analytical techniques are an integral component of the company’s ERM process and further support the company’s long-term financial strategies and objectives.

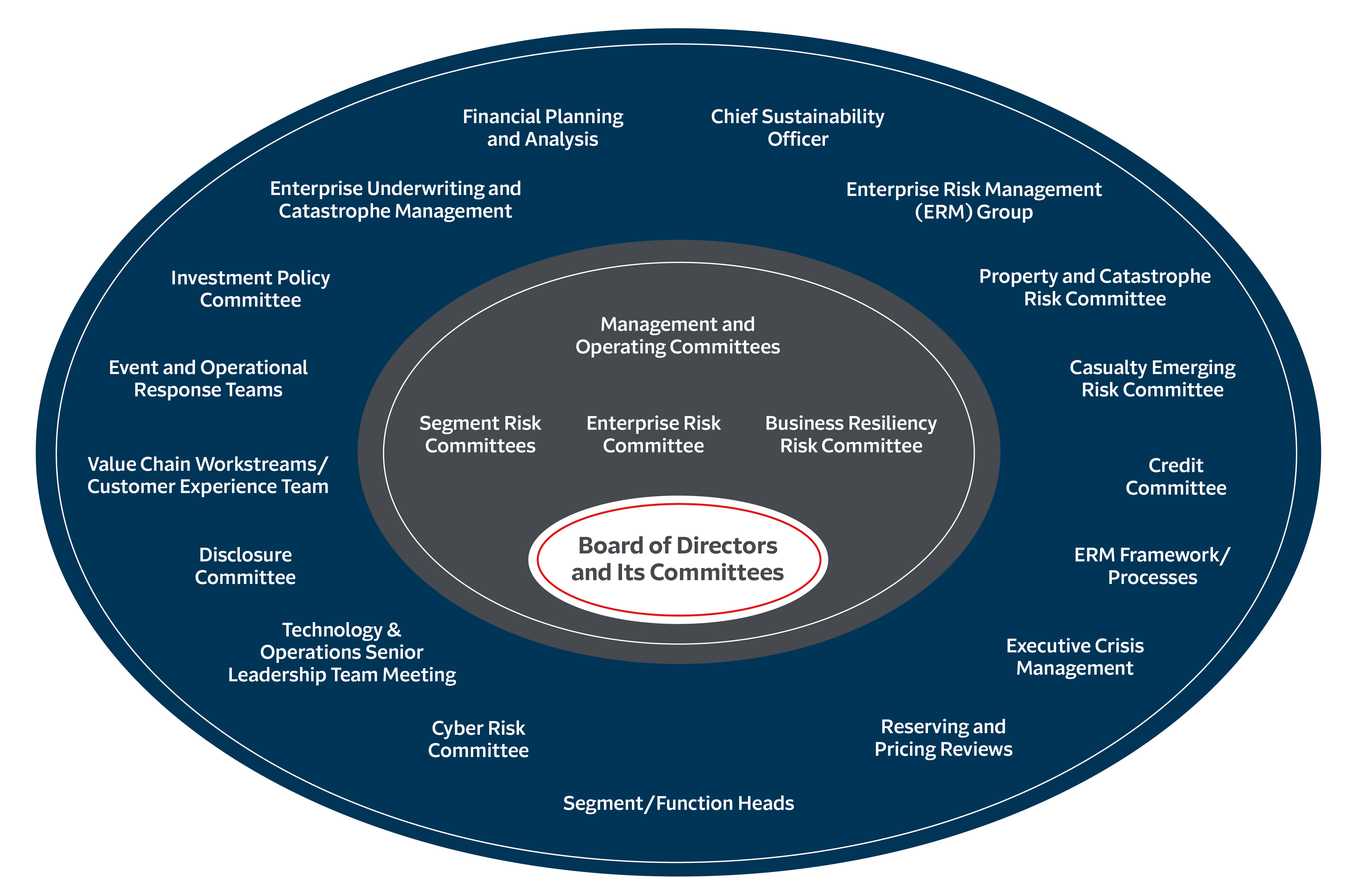

The diagram below illustrates some of the different groups, committees, functions and processes involved in our comprehensive approach to overseeing and managing risk.

Graphic consists of three overlapping ovals. The text on the smallest oval on the inside says Board of Directors and Its Committees. The oval around that one contains text that says Management and Operating Committees, Segment Risk Committees, Enterprise Risk Committee, Business Resiliency Risk Committee. The outermost oval contains text that lists Chief Sustainability Officer, Enterprise Risk Management (ERM) Group, Property and Catastrophe Risk Committee, Casualty Emerging Risk Committee, Credit Committee, ERM Framework/Processes, Executive Crisis Management, Reserving and Pricing Reviews, Segment/Function Heads, Cyber Risk Committee, Technology & Operations Senior Leadership Team Meeting, Disclosure Committee, Value Chain Workstreams/Customer Experience Team, Event and Operational Response Teams, Investment Policy Committee, Enterprise Underwriting and Catastrophe Management, Financial Planning and Analysis.

Board oversight of risk

Our Board of Directors oversees our ERM process. The Risk Committee and other committees of the Board are an essential part of our ERM framework and help to establish and reinforce our strong culture of risk management.

The Risk Committee of the Board meets with senior management at least four times a year to discuss ERM activities and provides a report to the full Board of Directors after each such meeting. This approach enables a high degree of coordination between management and the Board.

The Board Risk Committee oversees the implementation, execution and performance of the Travelers ERM program and reviews the strategies, processes and controls pertaining to Travelers’ insurance operations. The Board also allocates and delegates risk oversight responsibility to various committees of the Board. Accordingly, all committees of the Board share responsibility for oversight of strategic objectives, risk management and the sustainability of our business. We believe that allocating responsibility for specific risks to a committee with a particular skill set improves the effectiveness of the overall oversight of risks and opportunities.

The Board has allocated and delegated risk oversight responsibility to various committees of the Board as follows:

|

Audit Committee |

Responsible for oversight of risks related to the integrity of financial statements, including oversight of financial reporting principles and policies and internal controls; the process for establishing insurance reserves; and risks related to regulatory and compliance matters. Audit Committee Charter. |

|

Compensation Committee |

Responsible for oversight of certain human capital management matters, including the company’s compensation and pay-for-performance philosophy; compensation program objectives; practices designed to ensure equitable pay across the organization; risks related to compensation programs, including with respect to formulation and administration of those programs; and regulatory compliance with respect to compensation matters. Compensation Committee Charter. |

|

Investment and Capital Markets Committee |

Responsible for oversight of risks related to our investment portfolio (including valuation and credit risks), capital structure, financing arrangements and liquidity. Investment and Capital Markets Committee Charter. |

|

Nominating and Governance Committee |

Responsible for oversight of risks related to corporate governance matters, including director independence and related person transactions; certain human capital management matters, including succession planning, the employee code of conduct and workforce diversity and inclusion efforts; public policy initiatives; and community relations. Nominating and Governance Committee Charter. |

|

Risk Committee |

Responsible for oversight of ERM activities and risks related to business operations, including insurance underwriting and claims; reinsurance; catastrophe risk and the impact of changing climate conditions; credit risk in insurance operations; information technology, including cybersecurity; and business resiliency planning. Risk Committee Charter. |

More about capital & risk management

Enterprise risk management

Integrating Enterprise Risk Management (ERM) with an effective internal control environment enables our ERM group to foster, lead and support an integrated, risk-based culture throughout the company.

Business resiliency

Our approach to business resiliency is designed to allow us to deliver on the Travelers Promise to take care of our customers, communities and employees in the face of unexpected disruptions.

Balanced approach to capital management

Integral to our long-term financial strategy is a balanced approach to rightsizing capital and generating capital in excess of our growth needs.