Capital & Risk Management: Balanced Approach to Capital Management

Travelers has consistently provided excellent service to policyholders while delivering strong returns over time. Integral to our long-term financial strategy is a balanced approach to rightsizing capital and generating capital in excess of our growth needs. We maintain operating company capital at levels needed to support our current business profile and growth opportunities. Specifically, our capital models first address our need to comply with regulatory risk-based capital requirements and our desire to:

- Maintain credit ratings consistent with our capital strength objectives for the company.

- Continue to remain financially strong after a significant catastrophe event.

- Ensure that we can satisfy the claim payments and other obligations of our business.

To meet these objectives, we monitor our cash inflows (e.g., premiums, service fees, investment income) and outflows (e.g., claim payments, capital investments, operating expenses) on an ongoing basis. Since most of our policies renew annually, we regularly reassess our pricing and risk appetite against our capital needs.

Our capital management strategy has been an important driver of shareholder value creation over time. As we have said many times, our first objective for the capital we generate is to reinvest it – organically and inorganically – in our business to create shareholder value. We will continue to retain capital to support growth in our business and invest capital to further our ambitious innovation agenda and advance other strategic objectives. Today, we are making strategic investments in everything from talent to technology. Having said that, we are disciplined stewards of our shareholders’ capital, and to the extent that we continue to generate capital that we cannot reinvest consistent with our objective of generating industry-leading returns over time, we will manage it the same way we have for nearly two decades – by returning it to our shareholders.

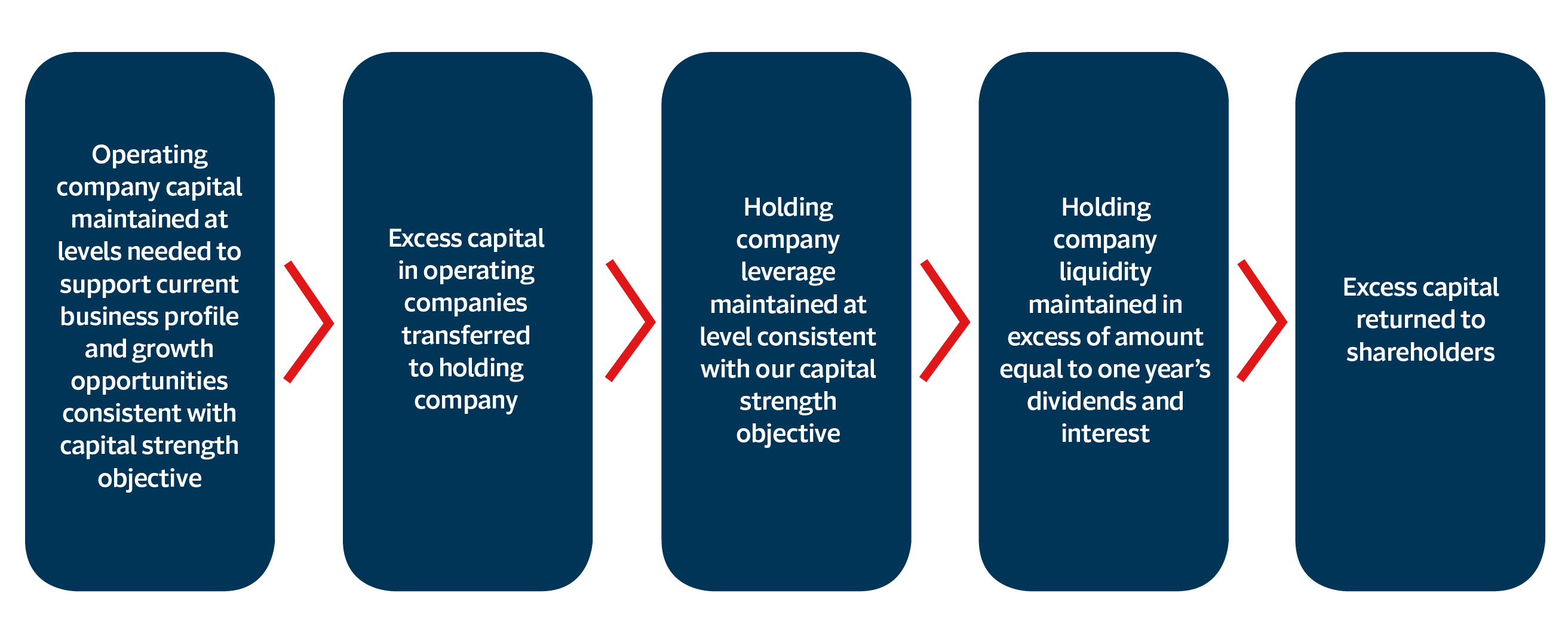

Our balanced approach to capital management

Our Balanced Approach to Capital Management. Travelers maintains capital at levels needed to support its current business profile and growth opportunities consistent with capital strength objective. Excess capital in operating companies transferred to the holding company. Holding company leverage is maintained at a level consistent with our capital strength objective, while liquidity is maintained in excess of an amount equal to one year’s dividends and interest. Excess capital is returned to shareholders.

Over the last 10 years, our financial success and balance sheet strength have enabled Travelers to grow dividends per share at an average annual rate of 7% while increasing our adjusted book value per share by 96%. These accomplishments are on top of returning approximately $26 billion of excess capital to the company’s shareholders over the same 10-year period. Our financial strength is also reflected in our strong credit ratings from four of the major rating agencies.

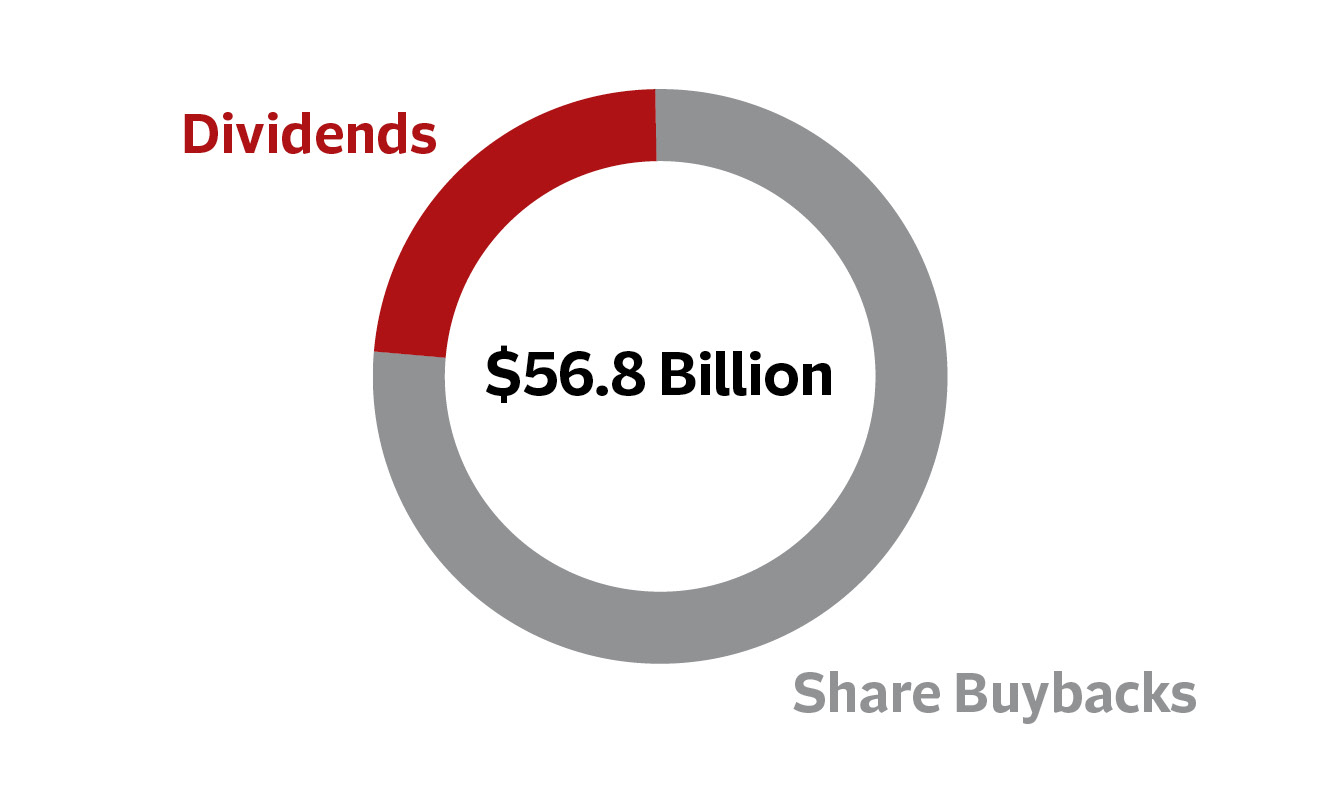

Since the initial share repurchase authorization in May 2006 and through December 31, 2024, Travelers has returned $56.8 billion of capital to shareholders: $42.2 billion in share repurchases at an average price of $74.97 per share and $14.6 billion in dividends.

More about capital & risk management

Approach

At Travelers, our Enterprise Risk Management activities involve both the identification and assessment of a broad range of risks and the execution of coordinated strategies to effectively manage these risks.

Enterprise risk management

Integrating Enterprise Risk Management (ERM) with an effective internal control environment enables our ERM group to foster, lead and support an integrated, risk-based culture throughout the company.

Business resiliency

Our approach to business resiliency is designed to allow us to deliver on the Travelers Promise to take care of our customers, communities and employees in the face of unexpected disruptions.