Investment Management

The primary purpose of our investment portfolio is to position us to fulfill our promise to our customers to fund future claim payments. For this reason, we employ a thoughtful investment philosophy that focuses on stable and appropriate risk-adjusted returns.

Approach

We strive to be thoughtful underwriters on both sides of our balance sheet, and we have always allocated our assets to support our insurance operations, not the reverse. Because the primary purpose of our investment portfolio is to fund future claim payments, Travelers employs a risk-adjusted approach to its investment portfolio. Our asset allocation gives us a high level of confidence that our capital is adequate to support our insurance business, in both good times and bad. Our approach has served us remarkably well over a long period and allows us to invest in our businesses with an eye to the future.

Our Co-Chief Investment Officers – members of our Management and Operating Committees – lead our Investment department, which directly manages our fixed income assets (94% of our investment portfolio), as well as our investments in equity securities, real estate, private equity limited partnerships, hedge funds, real estate partnerships and joint ventures. The Investment and Capital Markets Committee of the Board oversees our investment strategy and the risks related to our investment portfolio (including valuation and credit risks), capital structure, financing arrangements and liquidity.

Well-defined and consistent investment philosophy

Our investment portfolio is a key source of stability and strength for Travelers. The portfolio is managed first and foremost to support our insurance operations; accordingly, our investment portfolio is positioned to meet our obligations to policyholders under almost every foreseeable circumstance – anything from a global pandemic to a significant natural disaster to a financial crisis. With this in mind, we are focused on risk-adjusted returns and credit quality rather than reaching for yield that is not commensurate with the underlying risk. Our well-defined and consistent investment portfolio has been a meaningful and reliable contributor to our results year in and year out.

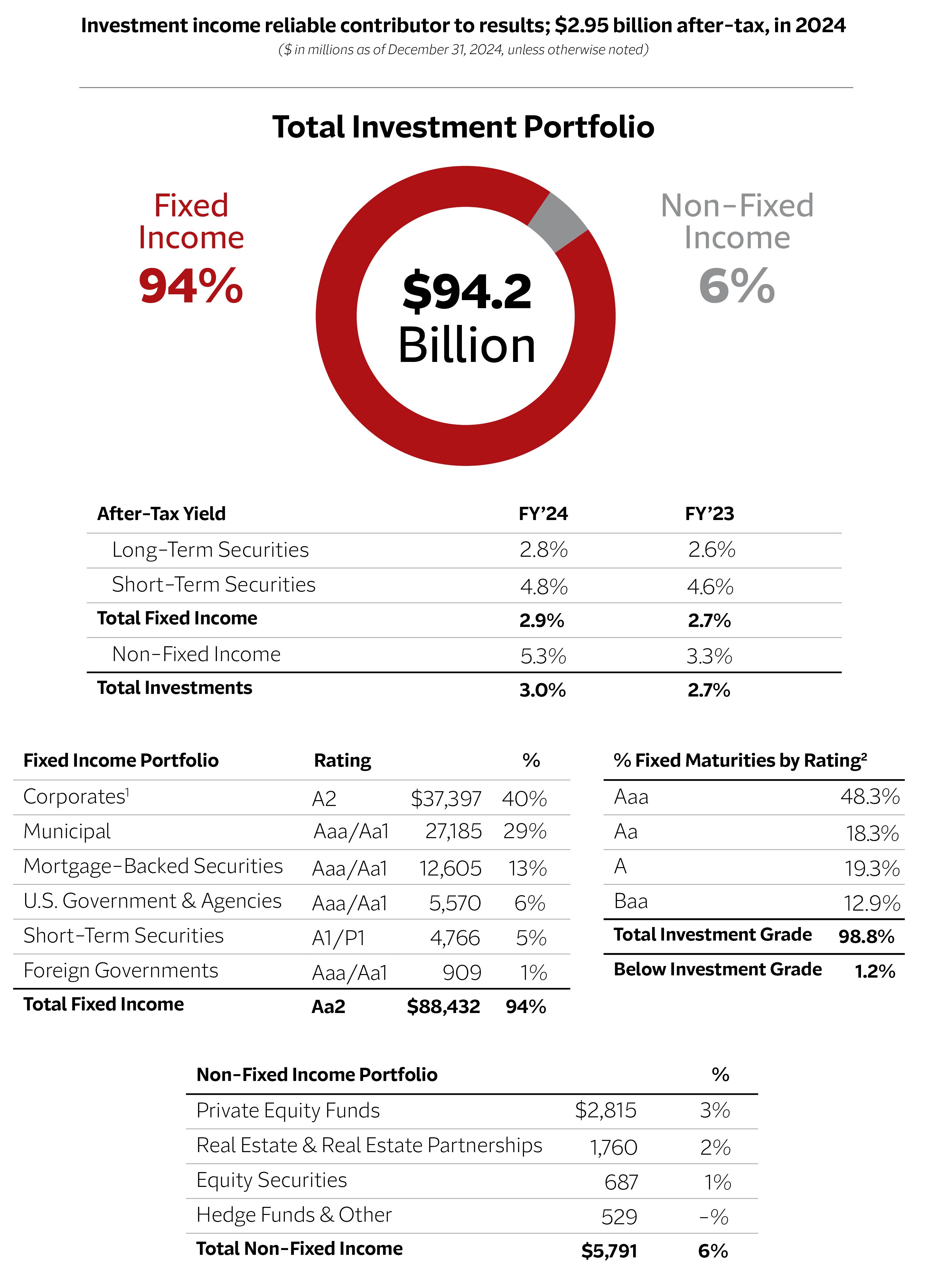

The performance of our investment portfolio in 2024 underscores the wisdom of our thoughtful and diversified approach. Net investment income was very strong at $2.95 billion after-tax, reflecting higher long-term and short-term average yields and a higher average level of fixed maturity investments.

Investment income reliable contributor to results; $2.95 billion after-tax, in 2024, dollars in millions as of December 31, 2024, unless otherwise noted.

Total Investment Portfolio. Travelers total investments amounted to $94.2 billion in FY’24. 94% of investments are held in a fixed income portfolio, including 69% in municipal and corporate investments. 6% are held in non-fixed income investments, including private equities and real estate. 98.8% of FY24 investments are investment grade, including 48.3% held in Aaa-rated investments.

AFTER-TAX YIELD

Long-Term Securities in 2024 were 2.8% and in 2023 were 2.6%

Short-Term Securities in 2024 were 4.8% and in 2023 were 4.6%

TOTAL FIXED INCOME in 2024 was 2.9% and in 2023 was 2.7%

Non-Fixed Income in 2024 was 5.3% and in 2023 was 3.3%

TOTAL INVESTMENTS in 2024 were 3.0% and in 2023 were 2.7%

FIXED INCOME PORTFOLIO

Corporates in 2024 were $37,397 and 40%

Municipal in 2024 was $27,185 and 29%

Mortgage-Backed Securities in 2024 were $12,605 and 13%

U.S. Government & Agencies in 2024 were $5,570 and 6%

Short-Term Securities in 2024 were $4,766 and 5%

Foreign Governments in 2024 were $909 and 1%

Total Fixed Income in 2024 was $88,432 and 94%

PERCENTAGE FIXED MATURITIES BY RATING

Aaa in 2024 was 48.3%

Aa in 2024 was 18.3%

A in 2024 was 19.3%

Baa in 2024 was 12.9%

Total Investment Grade in 2024 was 98.8%

Below Investment Grade in 2024 was 1.2%

NON-FIXED INCOME PORTFOLIO

Private Equities in 2024 were $2,815 and 3%

Real Estate & Real Estate Partnerships in 2024 were $1,760 and 2%

Equity Securities in 2024 were $687 and 1%

Hedge Funds & Other in 2024 were $529 and null %

Total Non-Fixed Income was $5,791 and 6%

1Includes $1.152 billion of Commercial Mortgage-Backed Securities with an Aaa/Aa1 rating and $472 million of Asset-Backed Securities with an Aa1 rating.

2Rated using external rating agencies or by Travelers when a public rating does not exist. Ratings shown are the higher of the rating of the underlying issues or the insurer in the case of securities enhanced by third-party insurance for the payment of principal and interest in the event of issuer default. Below investment grade assets refer to securities rated “Ba” or below.

More about investment management

Responsible investing

In addition to achieving appropriate risk-adjusted returns, our investments enable many environmental and social improvements.

ESG factors in investment decisions

We recognize the importance of responsible investment and, accordingly, incorporate relevant environmental, social and governance (ESG) factors in assessing the investment risks associated with the entities in which we invest.