Climate Strategy: Underwriting Strategy

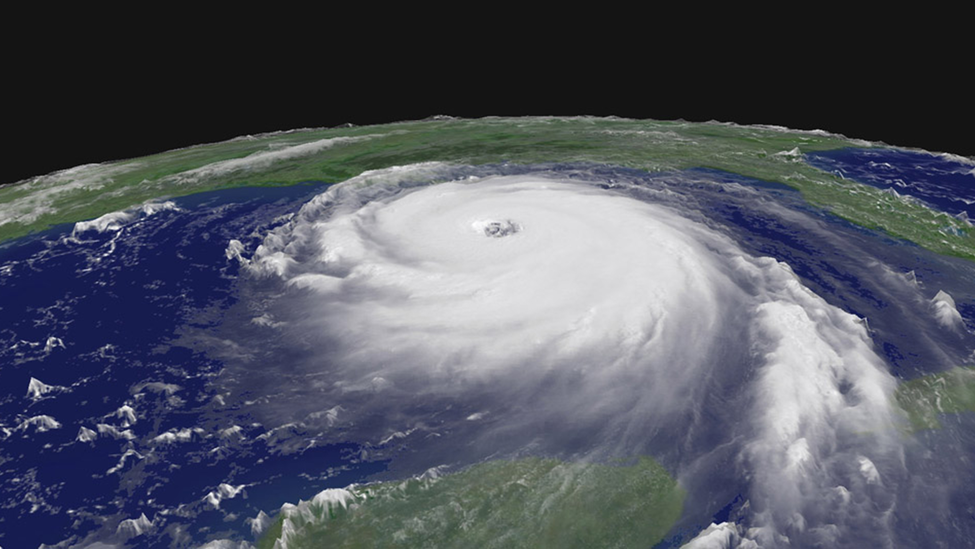

For both property and casualty lines of business, we consider environmental factors, including weather trends and patterns, alongside other relevant risk variables in our underwriting evaluation process and in our underwriting strategies. In addition to catastrophe modeling, discussed in further detail under Catastrophe & Weather Models, we evaluate the findings contained in governmental reports, such as the Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (AR6; 2021) and the U.S. Fifth National Climate Assessment Report (NCA5; 2023), as well as other external scientific studies related to climate, to assess potential impacts on our underwriting and pricing decisions. For example, we have evaluated the extent to which phases of the Atlantic Multidecadal Oscillation, the El Niño-Southern Oscillation, the North Atlantic Oscillation and Saharan dust conditions may influence changes in basin frequency, severity or U.S. landfall risk of hurricanes. Our catastrophe underwriting also incorporates lessons learned from recent events, including the 2017 Tubbs Fire (California), the 2018 Camp Fire (California), the 2019 Kincade Fire (California), several 2021 wildfire events in California and Oregon, the late-season 2021 Marshall Fire (Colorado), Hurricane Ian (Florida) in 2022, Hurricane Idalia (Florida) in 2023 and Hurricane Helene (Georgia) in 2024, as well as past events, such as Hurricanes Harvey and Katrina and Superstorm Sandy. These lessons learned are reflected in our:

- Disciplined approach to terms and conditions that are designed to make outcomes more predictable.

- Risk Control initiatives, which help us with risk mitigation, selection and pricing.

- Proprietary Commercial Property flood underwriting, which factors in building footprints compared with segmented flood zones.

- Proprietary wildfire underwriting, which factors in terrain slope, vegetation density and propensity to burn, and road access (including proximity to fire stations), as well as historical footprints.

We are able to respond quickly to changing conditions since most of our policies renew annually. This gives us the flexibility to adjust our pricing, underwriting strategy and related policy terms and conditions, as appropriate. In addition to making short-term tactical adjustments to our underwriting strategy and product pricing based on the climate-related risks we identify, we monitor climate-related risks on a medium- and long-term horizon to arrive at a holistic view of climate-related impacts on our business, further allowing us to adjust and refine our strategy, products and pricing.

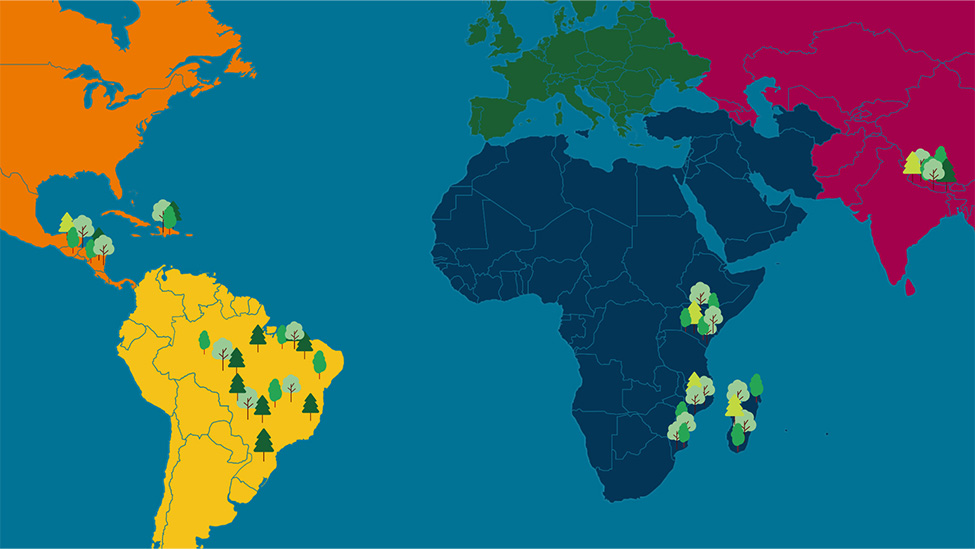

Our broad product diversity also mitigates our exposure to climate-related risks. We engage broadly across nine major lines of insurance through our three business segments – Business Insurance, Bond & Specialty Insurance and Personal Insurance. Our portfolio is balanced across these lines of business and further diversified by geography and customer size and type. Travelers is a leading U.S. commercial insurance writer with a top-five position in five major product lines, including a number one position in workers compensation and commercial multi-peril.1 See our Business Strategy & Competitive Advantages section to learn more about our product breadth and specialization.

Finally, informed by our risk selection, claim experience and risk appetite, we reinsure a portion of the risks we underwrite to further manage our exposure to losses and to protect our capital. We cede to reinsurers a portion of these risks and pay premiums based upon the risk and exposure of the policies subject to such reinsurance. For further discussion of our reinsurance program, see our Annual Report on Form 10-K.

Our robust risk management practices and disciplined approach to underwriting and pricing help Travelers identify and manage both the transition and physical risks related to changing climate conditions and respond to climate-related opportunities now and as these opportunities evolve over time.

Climate strategy scenario analysis with respect to physical risk

Travelers is proud to be a leader in its industry in conducting scenario analysis with respect to identifying the incremental climate impact on physical risk, above typical weather conditions. This analysis has provided the company with additional visibility into the potential impacts of climate on our business.

Within the last five years, we retained a leading catastrophe modeling firm to evaluate the effects of changing climate conditions on the U.S. hurricane peril for two future emission scenarios and for several time horizons (i.e., 2030, 2050 and 2100). In 2024, we also completed a wildfire climate review that evaluated scientific literature and third-party catastrophe models. Our independent trend analysis identified an increasing trend in climate variables relevant to wildfire risk, which Travelers has taken into account in its underwriting and pricing decisions.

Based on these analyses, given our company’s risk profile, our underwriting strategy and the fact that changing climate conditions will occur over decades, we do not expect the climate impacts with respect to the hurricane or wildfire perils to have a material impact to our average annual loss, return period loss estimates, planning or strategy. While we anticipate hurricane and wildfire risk to be manageable over time, these analyses provide insight into the range of potential future risk.

For a detailed discussion regarding the analyses and their results, please see our TCFD Report.

1 2024 U.S. Statutory DWP. Five major product lines: Commercial Multi-Peril (Commercial Multiple Peril (Liability), Commercial Multiple Peril (Non-Liability), Farmowners Multiple Peril); Commercial Auto (Commercial Auto No-Fault (Personal Injury Protection), Commercial Auto Physical Damage, Other Commercial Auto Liability); General Liability (Other Liability Occurrence, Product Liability); Workers Compensation; and Surety. Copyright © 2025, S&P Global Market Intelligence. Used with permission.

More about climate strategy

Approach

As a core part of our business, we continually monitor, assess and respond to the risks and opportunities posed by changing climate conditions to provide products and services that both help our customers mitigate associated risks and are priced to meet our long-term financial objectives.

Risk identification & management

The Segment Risk Committees are involved in identifying climate-related underwriting risks and climate-related opportunities in our book of business.

Catastrophe & weather models

Travelers uses various analyses and methods to evaluate our climate-related risks and make underwriting, pricing and reinsurance decisions designed to manage the company’s exposure to catastrophe events.

Products & services

As renewable energy businesses continue to innovate and expand, Travelers is playing a critical role in supporting the transition over time to a lower-carbon economy, both in the United States and internationally – specifically, through our insurance products and services designed for these innovative companies.

Resilient communities

As part of an ongoing effort to enhance public awareness about the need for effective adaptation strategies to reduce losses related to natural disasters, Travelers supports and participates in research, advocacy and education.

Illustrative initiatives

Environmental Initiatives in Europe

Growing the Travelers Europe Forest

IBHS Sponsorship

Supporting Research in Severe Weather Readiness and Response

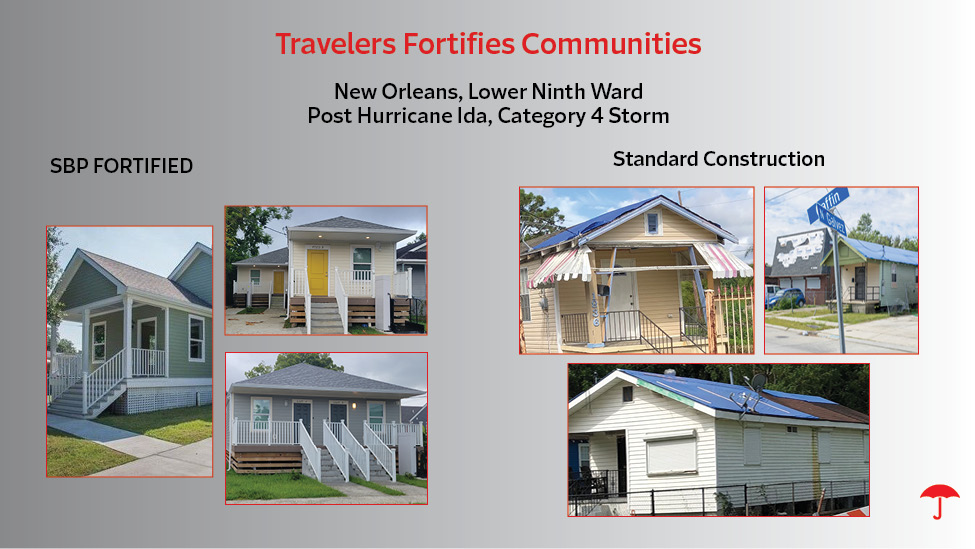

Travelers Fortifies Communities

Building Strong, Resilient Communities

Travelers Institute®

Thought Leadership on Disaster Preparedness

Wildfire Defense Services

Protecting Our Customers from Increased Wildfire Risk