Ethics & Responsible Business Practices: Responsible Business Practices

The business of insurance involves a contractual arrangement in which the insurer agrees to bear a policyholder’s expected risk of future financial loss, subject to agreed limits, terms and conditions, in exchange for a premium. This requires insurers, such as Travelers, to design and price their insurance products based on expected risk of future loss. Under long-standing law and insurance industry practice, Travelers identifies risk factors and establishes rates based on sound actuarial principles that do not – and may not – take factors such as race or other prohibited characteristics into account. Established principles of risk-based insurance underwriting and pricing allow insurance markets to function properly, fairly and competitively. Ultimately, this approach benefits customers by increasing the availability of insurance at fair prices that appropriately reflect the related risks and ensures the financial solvency of insurers to pay covered claims decades into the future.

To estimate the risk of future loss, actuaries apply mathematics, statistics and economic methods to estimate the probability and financial impact of various risk factors. The procedures through which rates are set are complex, but the theory behind the process is straightforward – insurance actuaries and underwriters seek (and are required by law) to determine risk factors that correlate with losses. This assessment of risk is designed to accurately identify the expected value of all future costs associated with risk transfer. Ultimately, the grouping of risks with similar characteristics is fundamental to any insurance system. Importantly, there are certain characteristics, including race, that insurers are legally prohibited from considering and that are not part of the process used by actuaries to establish rates.

Regulated domestically through state Departments of Insurance in all 50 states and the District of Columbia, the company’s operating subsidiaries, like other insurance companies, are subject to extensive state laws and regulations touching on all aspects of their business, including pricing and underwriting. Through its insurance subsidiaries, the company offers a wide range of insurance products across many lines of business, each of which is subject to detailed legal and regulatory filings and state laws. Notably, rates are generally filed with, and reviewed and approved by, state insurance regulators, which uniformly require insurers to establish that their filed rates are “adequate,” not “excessive” and not “unfairly discriminatory,” as those terms are defined under each jurisdiction’s laws. To ensure compliance with these well-established standards, these insurance regulatory authorities also perform periodic market conduct and financial examinations, in part to ensure that customers are charged premiums that are adequate and not excessive or unfairly discriminatory under the law.

In light of the heavily regulated environment in which it operates, Travelers has developed thoughtful and comprehensive underwriting and pricing policies and practices, including robust governance and controls designed to ensure that its pricing is actuarially sound and that its underwriting and pricing practices comply with all applicable laws and do not consider race or other prohibited characteristics. Key components of Travelers’ comprehensive governance and controls include:

- Underwriting and Pricing Policies, Practices & Governance.

- Travelers Responsible Artificial Intelligence Framework.

- Data Governance, including the use of Third-Party Data.

- Awareness, Education and Training.

- Internal Audit and Regulatory Oversight.

- Enterprise Risk Management, Senior Leadership Accountability and Board Oversight.

Robust underwriting & pricing policies, practices & governance

Risk-based underwriting and pricing practices and fair access to our insurance products are at the core of the insurance industry and the company’s business. To that end, and to ensure that the underwriting and pricing factors the company considers are predictive of risk and appropriate to use, underwriting decisions are made within a collaborative, structured and cross-disciplinary approach. This approach includes: (i) extensive underwriting guidelines; (ii) a structured underwriting authority framework; and (iii) a quality assurance audit process. The extensive underwriting guidelines provide each underwriter with clear and established direction on how to properly evaluate risks. The highly structured underwriting authority framework, which ensures the appropriate underwriting rigor and discipline are applied, requires collaboration at both the transactional and portfolio level. The company’s underwriting audit process confirms compliance with our policies and underwriting framework and includes both quality assurance audits and targeted reviews to verify, among other things, appropriate risk selection, underwriting quality and compliance with best practices and controls. Among these controls are the company’s policies establishing that it will comply with all applicable laws, including laws prohibiting discrimination based on any legally protected characteristic, including race.

With respect to pricing, the company’s credentialed actuaries are professionally certified and, in the United States, must be members in good standing of the Casualty Actuarial Society or the Society of Actuaries, or fully qualified members of another IAA-member organization. Among other things, this requires adherence to the applicable code of professional conduct, adherence to the applicable jurisdiction’s qualification standards and participation in the applicable actuarial boards for counseling and discipline. The qualifications and standards are important because the Actuarial Standards of Practice, for example, provide that when U.S. actuaries are performing professional services such as designing, reviewing or changing risk classification systems, actuaries must comply with applicable laws, including those laws prohibiting the consideration of protected characteristics, including race.

As the company’s business practices have evolved, Travelers has also developed and employed advanced statistical processes – more commonly referred to as “models” – to assist it in the underwriting and pricing of its insurance products. Similar to the underwriting and pricing controls described above, the company also has robust governance and controls in place to ensure the integrity of its modeling practices, including verification that all risk factors used are actuarially justified as predictive of risk and comply with state laws.

As part of its practices, the company conducts comprehensive reviews of its models, running them through a multidisciplinary process that includes, as appropriate, peer, legal, actuarial and data science assessments that span the entire model life cycle. This well-established governance, which has been reviewed by the company’s lead regulator, is embodied in the Travelers Model Risk Management Framework. Critical elements of this framework include: (i) Travelers Modeling Guidelines, which provide overall guidance on the creation and life cycle of models; (ii) a risk assessment tool, which is used to evaluate the risk level of each model; (iii) model checklists, which specify required risk mitigation controls based on the risk level of each model; and (iv) an inventory of models.

The Model Risk Management Framework addresses:

- Data quality.

- Compliance with all applicable laws and regulations.

- Model explanation and documentation.

- Appropriate peer and legal reviews of the model.

- Model implementation and post-model implementation monitoring.

To help ensure legal and regulatory compliance, Travelers reinforces and confirms that those involved in the modeling life cycle follow the guidance and requirements of the Model Risk Management Framework. Through this process, model owners are expected to confirm that the model complies with the Travelers Modeling Guidelines, has been reviewed with the appropriate subject matter experts, and has been signed off on by peer and legal reviewers. Peer reviewers – within and across business lines – consider, among other factors, the data utilized, the data sources, the variables utilized and the methodology utilized to select those variables to ensure they are appropriate and consistent with the Modeling Guidelines. Legal reviews are similarly designed to ensure compliance with applicable laws (including antidiscrimination laws) and regulations, as well as internal Travelers policies. These peer and legal reviews evaluate model use cases, data sources, risk assessment and the variables used in the models.

Responsible Artificial Intelligence Framework

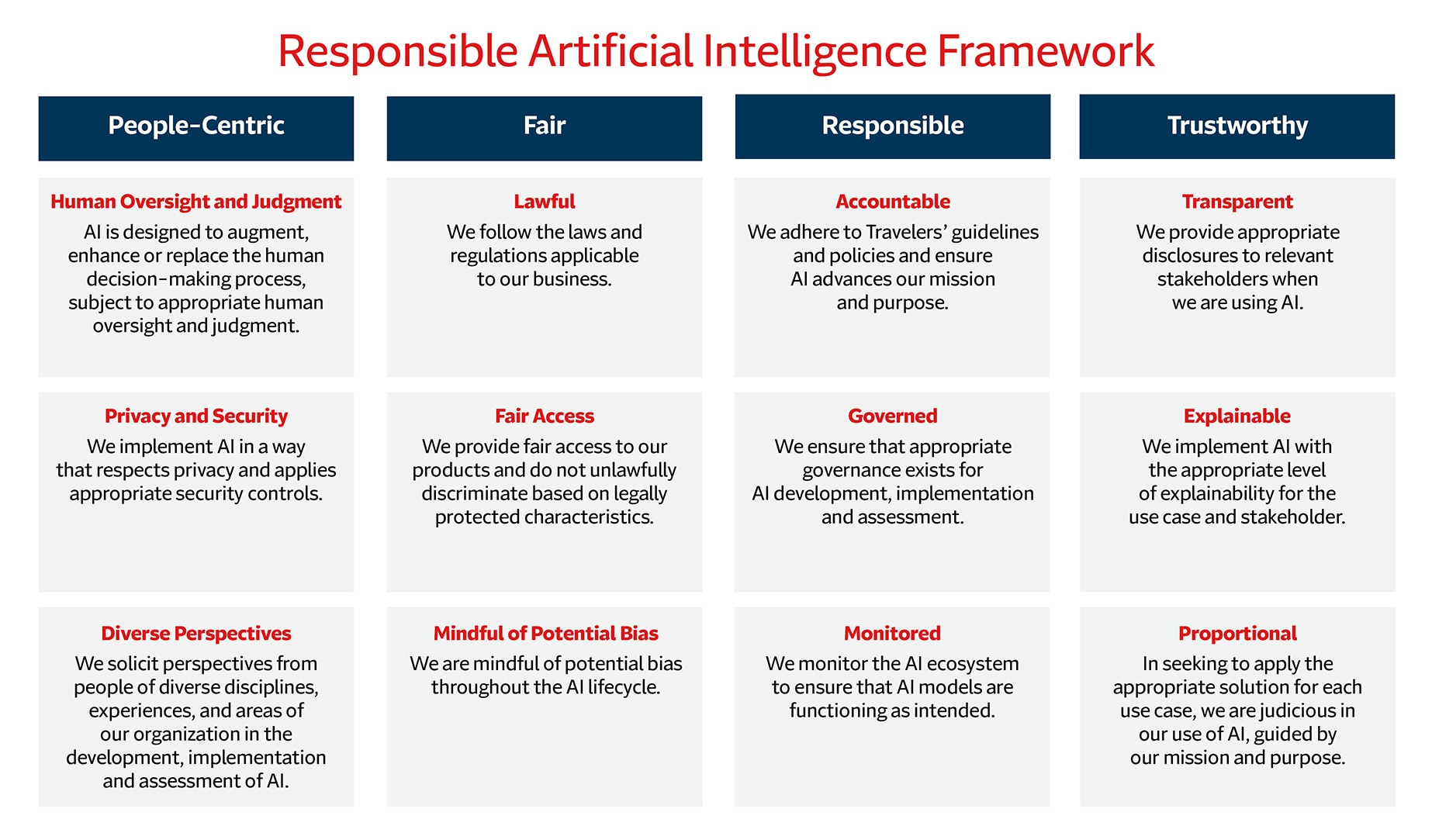

As part of the constant evolution and maturation of Travelers’ governance framework, the company has also established a Responsible Artificial Intelligence Framework that sets forth foundational principles to guide our development and use of AI, advanced analytics and modeling. The goal of this framework is to help ensure that we act responsibly and ethically – consistent with the responsible business values at the heart of our business and culture.

As depicted below, the framework consists of our core principles that describe how we use AI: People-Centric, Fair, Responsible and Trustworthy.

Responsible Artificial Intelligence Framework

As part of the constant evolution and maturation of Travelers’ governance framework, the company has also established a Responsible Artificial Intelligence Framework that sets forth foundational principles to guide our development and use of AI, advanced analytics and modeling. The goal of this framework is to help ensure that we act responsibly and ethically – consistent with the responsible business values at the heart of our business and culture.

As depicted below, the framework consists of our core principles that describe how we use AI: People-Centric, Fair, Responsible and Trustworthy.

People-Centric

- Human Oversight and Judgment. AI is designed to augment, enhance or replace the human decision-making process, subject to appropriate human oversight and judgment.

- Privacy and Security. We implement AI in a way that respects privacy and applies appropriate security controls.

- Diverse Perspectives. We solicit perspectives from people of diverse disciplines, experiences and areas of our organization in the development, implementation and assessment of AI.

Fair

- Lawful. We follow the laws and regulations applicable to our business.

- Fair Access. We provide fair access to our products and do not unlawfully discriminate based on legally protected characteristics.

- Mindful of Potential Bias. We are mindful of potential bias throughout the AI lifecycle.

Responsible

- Accountable. We adhere to Travelers’ guidelines and policies and ensure AI advances our mission and purpose.

- Governed. We ensure that appropriate governance exists for AI development, implementation and assessment.

- Monitored. We monitor the AI ecosystem to ensure that AI models are functioning as intended.

Trustworthy

- Transparent. We provide appropriate disclosures to relevant stakeholders when we are using AI.

- Explainable. We implement AI with the appropriate level of explainability for the use case and stakeholder.

- Proportional. In seeking to apply the appropriate solution for each use case, we are judicious in our use of AI, guided by our mission and purpose.

Thoughtful data governance

The Travelers Enterprise Data & Analytics team, working with the company’s business segments and support functions, including Legal and Corporate Ethics and Compliance, strives to ensure that we appropriately manage our data, utilize accurate and reliable data, and implement thoughtful data governance across the organization. As discussed in further detail in the Harnessing the Power of Data & Knowledge section of this report, we have cultivated a data culture throughout the enterprise that emphasizes, through training and education, the importance of all employees taking ownership of data, understanding and protecting data, capturing and using data appropriately, and making sure the data we use is accurate and timely. We also have established, and monitor adherence to, enterprise- and business-line specific data governance policies and standards.

We have additional governance in place relating specifically to the third-party data we use to augment and/or enrich our own data. These processes and controls are designed to ensure the accuracy, completeness, consistency, timeliness and relevance of the third-party data and compliance with all applicable legal requirements, among other critical factors.

Targeted education & training with respect to responsible business practices

We require our employees who are involved in underwriting and pricing to take training with respect to the company’s underwriting and pricing policies. Moreover, we provide relevant employees with additional training regarding Travelers’ responsible business practices. For example:

- Model governance. We employ a multifaceted approach to ensure that modelers are appropriately aware of, and educated and trained on, our Model Risk Management Framework. Awareness and training start at the beginning of an employee’s tenure on a modeling team and continue throughout. We further reinforce this training and education by requiring all data scientists and decision scientists to complete a training knowledge check regarding the Model Risk Management Framework, and we obtain written confirmation that they have read and understood the various governance requirements.

- Data governance. We create and support a data culture by raising awareness and providing training regarding the appropriate uses and management of data. Travelers’ data culture training is focused on ensuring that we take ownership of data, understand data, protect data, capture data completely and make sure data is accurate and timely.

- Responsible AI. We reinforce awareness of our Responsible Artificial Intelligence Framework through training for Travelers’ Data & Analytics community. This training program covers the foundational principles that guide Travelers’ development and use of AI and the importance of acting responsibly and ethically – consistent with Travelers’ business values and culture. This training is also available to all employees.

Ongoing internal audit and regulatory oversight

Our Corporate Audit department provides objective, independent, risk-based evaluations of the design and operating effectiveness of governance, risk management and internal control processes throughout the company, while supporting the company’s Sarbanes-Oxley and Model Audit Rule compliance initiatives. Corporate Audit’s evaluations include reviewing controls related to underwriting, pricing and model governance, as well as data governance, among other areas. On a quarterly basis, the company’s Chief Auditor reports to the Audit Committee of the Board of Directors with respect to the results of Corporate Audit’s work and its overall conclusions regarding the internal control environment.

In addition to our own internal audits, we are also subject to comprehensive supervision and regulation by insurance regulatory authorities in the states in which the company operates. For example, rates are generally filed with, and reviewed and approved by, state insurance regulators, which uniformly require insurers to establish that their filed rates are “adequate,” not “excessive” and not “unfairly discriminatory,” as those terms are defined under each state’s laws. In addition to regulating rate filings, these insurance regulatory authorities also conduct periodic financial examinations and market conduct examinations, in part to ensure that regulatory requirements are satisfied and that customers are charged premiums that are adequate and not excessive or unfairly discriminatory under the law.

Numerous state legislators and regulators have also been actively evaluating the issue of race in insurance, as this is a topic that must be addressed on an industrywide basis. For example, in a statement to the U.S. Senate in September 2022, the Chair of the National Association of Insurance Commissioners (NAIC) committee leading the organization’s work in this regard testified that “there is considerable activity by state insurance regulators” and specifically outlined numerous initiatives actively being undertaken by the NAIC on the intersection of insurance and race.1 The company continues to monitor and track these developments as well as communicate with regulators to ensure that Travelers is not only complying with all applicable laws but also partnering on this important work.

Effective enterprise risk management, senior leadership accountability & board oversight

As part of the Enterprise Risk Management framework, risks are assigned to senior leadership risk owners who have accountability for establishing appropriate processes and monitoring. Additionally, pursuant to its charter, the Risk Committee of the Board of Directors is responsible for overseeing “the strategies, processes and controls pertaining to the underwriting of insurable risks and the pricing of such risks,” including the processes and controls that are designed by management to ensure that pricing is actuarially justified as predictive of risk and complies with applicable state laws. For more detailed information about the Board’s oversight process, see the Capital & Risk Management section of this report.

1 Testimony of Kathleen A. Birrane, Maryland Insurance Commissioner, on behalf of the National Association of Insurance Commissioners, September 8, 2022.

More about ethics & responsible business practices

Approach

The commitment of our employees, officers and directors to our Code of Business Conduct and Ethics, applicable laws and regulations, and company policies helps to ensure the long-term success of our organization.

Ethics & compliance training & awareness

Upholding a culture of honesty, integrity and accountability is critical to the long-term success of our organization. To support this culture, we promote ethics and compliance awareness across our operations.

Ethics helpline

Our independently administered Ethics Helpline is available to employees and others 24 hours a day, seven days a week.